|

| Source: US-BLS |

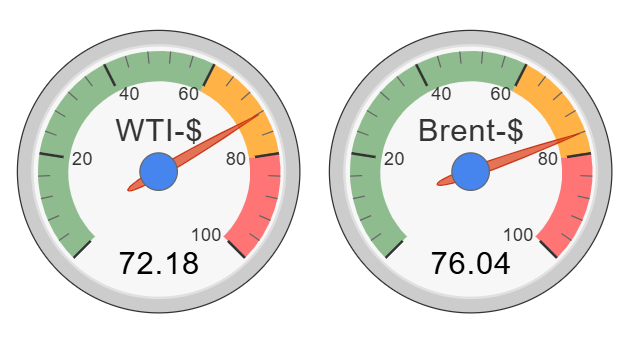

This uptick defied expectations, as U.S. crude oil inventories grew, a factor that typically depresses prices. Analysts attribute the anomaly to geopolitical uncertainty, particularly the souring U.S.-Europe relationship over Ukraine.

During his 2024 campaign, President Trump spotlighted inflation—then elevated due to high energy costs—as a key issue, promising to tame it by slashing energy prices. Inflation averaged 5% under Biden, peaking at 9.1% in June 2022, before cooling to 2.9% by December 2024.

Since Mr Trump’s inauguration on January 20, 2025, however, inflation has edged up to 3% in January, with preliminary February data suggesting a slight further rise. High energy costs remain a hurdle, and Mr Trump’s pledge has yet to materialize.

His cornerstone policy, encapsulated in the “drill, baby, drill” mantra, aims to boost domestic oil and gas production. An executive order on Inauguration Day loosened bureaucratic constraints, but tangible results are lagging. U.S. crude stocks are rising, yet prices remain stubborn, prompting Mr Trump to urge OPEC+ to increase output—a strategy echoing past administrations.

OPEC+ and Global Supply Dynamics

OPEC+, led de facto by Saudi Arabia, has resisted President Trump’s calls. At current prices, Saudi Arabia struggles to break even, while other members, eager to bolster their treasuries, quietly favor higher production. This internal rift masks a united front on output cuts.

In 2022, President Biden faced similar resistance during a meeting with Crown Prince Mohammed bin Salman. When OPEC+ rebuffed him, Mr Biden withdrew Patriot air defense systems from Saudi Arabia—then under Houthi attack—and tapped the Strategic Petroleum Reserve (SPR). Alongside allied releases, this capped oil prices below $80 per barrel, a psychological threshold. Inflation, however, stayed high, fueling Republican attacks and contributing to Biden’s 2024 electoral loss.

President Trump may be considering a similar short-term supply boost, but his long-term vision hinges on domestic production and a surprising diplomatic gambit: rapprochement with Russia.

The Russia Angle and U.S.-Europe Tensions

Mr Trump’s outreach to Russia, led by President Vladimir Putin, blends economic and strategic goals. Officially, he aims to reduce military spending and casualties in Ukraine. Economically, he seeks to restore Russian oil and gas flows to global markets, easing commodity prices and U.S. inflation. This strategy has strained ties with Europe, where leaders fear diminished U.S. security support against existential threats.

President Trump’s optimism—rooted in instinct, not details of experts —bets on European acquiescence, but the continent remains divided, unlikely to unify against his approach.

If successful, Russian supply could depress crude prices further, offering Mr Trump a win on inflation. President Putin shares this hope, eyeing normalized diplomatic and trade ties. Yet, the plan risks backfiring if Europe doubles down or if domestic production falters.

Outlook.

As of February 2025, President Trump’s inflation fight is off to a rocky start. Energy prices, a linchpin of his strategy, are rising amid geopolitical friction rather than falling as promised. Domestic output is ramping up slowly, OPEC+ is uncooperative, and the Russia pivot is a wild card. Inflation, hovering around 3%, isn’t yet the crisis of 2022, but Mr Trump’s success hinges on delivering tangible relief soon—lest he mirror Biden’s fate.