The energy markets breathed a sigh of relief on Friday, as the military conflict between the arch-enemies in the Middle East, Israel and Iran, appeared to have subsided - at least, for now.

As the news trickled in about an Israeli strike inside Iran in the morning on Friday, it was not clear what really was going on in the Islamic Republic: the airspace was closed all of a sudden in the wee hours on Friday; there were reports about explosions in the city of Isfahan, the third largest Iranian city of immense cultural significance as well as the home for major military sites and above all, Iranian nuclear sites.

The Iranian authorities downplayed the attack while reopening the airspace for flights in a couple of hours. The US military officials, meanwhile, had already confirmed about the attack and the involvement of Israel in it. Israel, however, as usual, kept mum about it, neither denying nor admitting it.

A four letter Tweet, 'lame', from a member of the Israeli war cabinet set the record straight - finally; while venting his frustration out, Itamar Ben-Gvir, the right-wing politician, confirmed that it was Israel that carried out the attack; the mode of operation, however, remained a mystery until late Friday evening: according to some media outlets, it was carried out by fighter jets without flying into the Iranian skies; the Iranians sources say they were drones, implying an insider-job; the Pentagon sources say the target was the air defence system surrounding a major Iranian nuclear site.

Throughout this week, the tension between the two key players in the Middle East had been rising that led to the fear of a major escalation, which could have potentially evolved into a major crisis - with a fault line emerging along the familiar Shia-Sunni divide of the Islamic faith; Iran had already violated airspace of Iraq and Jordan while sending its salvo of missiles and drones to the Jewish state. Israel could have done the same in bridging the gap of nearly 2000km that geography divides the two old foes.

In short, the stage was set for the neighbouring, mainly-Arab nations to be sucked into the war by design; perhaps the pressure from the US appeared to have done the trick in calming down the Israeli authorities, in return for vetoing the UN security council resolution over Palestinian statehood and giving the green light - reluctantly - for a measured Rafah operation without harming civilians, the last remaining Hamas stronghold in the Gaza Strip; both the US and Israel remain tight-lipped over any potential deal, compelling analysts to just guess it.

Against this backdrop, the crude oil markets reacted to the news of the Israeli attack inside Iran; the price of oil spiked briefly, only to come down later on.

Throughout this week, against all odds, the price of crude oil did not go up steeply; on the contrary, it went down in the last few days - very unusual, indeed.

Just after the massive missile attack launched by Iran against Israel, some analysts and of course, certain investment bankers predicted that oil price could go up as high as $100 due to potential supply disruptions. It, however, did not happen, nor is there any sign of it in the offing, judging by the recent price movements.

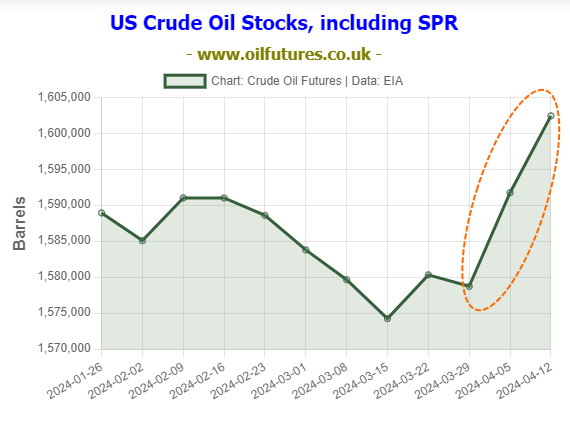

Some analysts attribute it to the fact that the US crude oil inventories rose rapidly this week, implying the lack of demand from the US consumers; high inflationary pressure and the uncertainty over interest rate cuts hardly boost the consumer confidence in the world's largest economy - and the world's largest consumer of oil and gas.

In addition, the extensive naval presence by the Western Navies in and around the Red Sea and the Strait of Hormuz, the crucial bottleneck through which 30% crude oil - 20 million barrels - moves towards the markets, appeared to have secured the region while minimizing the potential disruptions.

The fact that the oil and gas prices did not go up despite the region that is crucial for the two commodities in turmoil, indicates that the world is not out of the woods yet, as far as the global economy is concerned; moreover, there is enough of each commodity in the markets at present, especially when the countries in the northern hemisphere slipping into warmer weather as the spring has set in.

The stubborn tendency of the oil prices to remain relatively static, despite the potential for major supply disruptions, may worry the OPEC+ members in the long run: they cut down on productions solely for the purpose of shore up the prices, all to no avail.

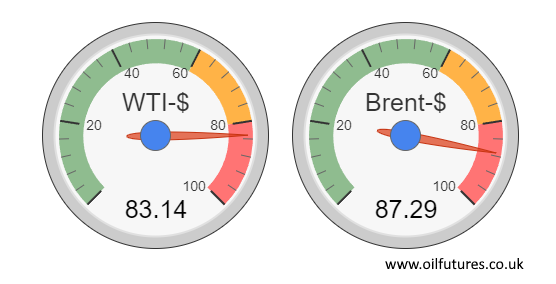

In a new development, meanwhile, the IMF, according to Bloomberg, has said that Saudi Arabia has to sell oil at $96.20 a barrel to balance its books this year - much higher than previously thought. As of 18:00 GMT, the price of WTI and Brent were at $83.14 and $87.29 respectively, compelling the Kingdom to find strategic measures to address the issue in the presence of a yawning gap between two price levels - the current price and break-even price.

Since the current volatility in the Middle East failed to push up the oil prices, defying the sentiments, most investors are pinning their hopes on the state of the Chinese economy - the world's second largest consumer of oil; in March, the Chinese manufacturing activities accelerated while recording its key index, the Manufacturing PMI, above the threshold, 50% - a growth - having been below it for months. China is going to release the same figure for April at the end of this month.

All in all, some encouraging news from China appears to be the only breather for the crude oil markets to feel a sense of optimism for the coming months.