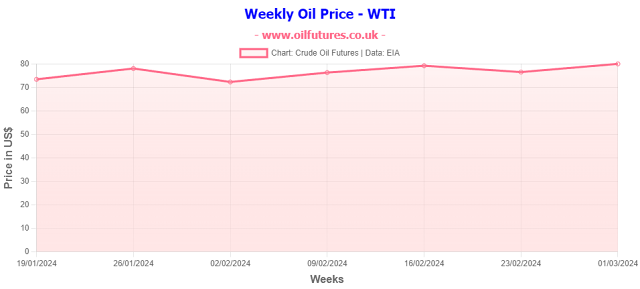

The price of crude oil shot up slightly at the beginning of this week, only to come down closer to where it had been in the last few weeks. The price of LNG, liquified natural gas, meanwhile saw its biggest drop in its recent history.

As of 18:00 GMT on Friday, the prices of two major benchmarks, WTI and Brent, were at $79.97 and $83.55 respectively; the price of LNG was at $1.84 .

The speculation over yet another production cut, analysts believe, may be the cause of rise in oil price this week. It, however, fell down again as the weekend approached, implying the acute challenges faced in maintaining the sustainability; the crude stock build, reported by the EIA, US Energy Information Administration, may have put a damper on the upward trend too.

Data Source: EIA - US Energy Information Administration

As far as the OPEC+ is concerned, they say that they stick to the voluntary production cuts announced on 30 November, 2023 - 2.2 million barrels a day; the cartel says that the measure is for supporting the stability and balance of the oil marking - a coded reference to looking after the group's own interest first.

The production cuts, judging by where the oil prices stay at present, did not shore up the prices; on the contrary, it led to causing some dissension among relatively poorer members of the organization, especially from Africa, as their oil revenues were hit.

Angola, for instance, left the OPEC+ on 21 December, 2023, shortly after the last OPEC+ meeting, clearly being frustrated over production cuts: oil revenue accounts for 30% of its GDP and it goes without saying the potential economic cost in the event of a major production cut that the more powerful members were planning to impose upon the African nation in the name of voluntary cuts.

It, indeed, dealt a significant blow to the OPEC+ that used to put on a brave, united front, concealing fissures.

The yawning gap between those who are in favour of increased production cuts and those who oppose it, has since widened and so has that of the successive meetings of the OPEC+.

The sudden rise in oil price this week, in this context, is more of an anomaly than a reliable spike prompted by a substantiated catalyst. In short, the production cuts, voluntary or not, failed to shore up the dwindling oil prices and the ball is now in the cartel's courts to coming up with a constructive strategy - deviating from the well-hackneyed path.

They can borrow a leaf out of the book of former President Mohamad Nasheed of the Maldives: he held a cabinet meeting underwater in order to highlight the plight of the inhabitants due to rising sea levels from the Global Warming. It did grab the attention of the global media as well as the decision making bodies at that time - a pretty successful PR stunt and a smart move.

In these circumstances, if I were an influential member of the OPEC+, I would advocate a multi-pronged approach for dealing with the mounting challenges faced by the organization that has been in existence for over six decades: the approach falls into production management, collaborative effort and of course, transparency coupled with effective communication.

As for the production management, the OPEC+ needs to maintain flexibility rather than adopting rigid production cuts as the only way to boosting its own interests. Instead of following what members love to hear, they can make use of real time data and short-term forecasts - as opposed to long term forecasts - in order to make dynamic adjustments to its production strategy. Adaptability to changing global demands is neither a sign of weakness nor succumbing to the inevitable - far from it.

In addition, the members can invest more on new technologies and enhance existing infrastructure in order to increase the efficiency of production whereby they can reduce the cost of production per barrel. Despite being fierce rivals, the OPEC+ can extract some inspiration from the shale oil producers of the US, who have been displaying the art of survival in the highly challenging circumstances.

Moreover, there is no better time in exploring alternate revenue streams in inverse proportion to the contribution from the renewables, as the latter is not going to die down. Revenues earned this way would help the member nations to mitigate the impact on coffers, when the oil price drops and production cuts are imposed on them to counter it.

As for the collaborative effort, the more influential members can listen to the grievances of the poorer members and keep communication channels open while addressing the real concerns of the latter. That will enhance the cooperation within the OPEC+ that in turn helps the organization to move forward as a united front.

In addition, the OPEC+ needs to be engaged with major consuming nations such as China, India, Japan and South Korea as they drive the global economy as a whole. The OPEC+ had a frosty relationships with them in the past, especially with India, over production cuts that damaged their economies. A regular dialogue with the countries in question leads to fostering a collaborative approach that will result in market stability.

As a further measure, the OPEC+ can get involved in the global security initiative to make sure there will not be disruptions to global energy supplies due to unforeseen socio-economic developments.

As for transparency and communication, the OPEC+ clearly needs to communicate its production strategy - or that of cutting it - and the corresponding rationale effectively to the stakeholders, mainly its customer base. Unless the cartel broadens the the communication to the consumers at every level and the public, production cuts do more harm than good to the reputation of the organization for ignoring significant stakeholders in the game. Adding insult to injury, it can lead to unhelpful speculation and failure in curbing misinformation.

All in all, the OPEC+ just cannot go with over-the-top long-term optimistic forecasts as there are clear signs that the demand is not going to see a steep rise, let alone an exponential growth. It clearly needs to adopt out of the box thinking as a matter of urgency.

It reminds us of the prophetic words of a giant in the realm, who used to run the organization like a cult leader - Sheikh Ahmad Yamani of Saudi Arabia.

"The stone age came to an end, not because of a lack of stones and oil age will come to an end, not because we have a lack of oil," said Sheikh Yamani to a British newspaper in an unprecedented interview in June, 2000. The OPEC+ needs to take heed of his prediction - seriously.