|

| www.oilfutures.co.uk |

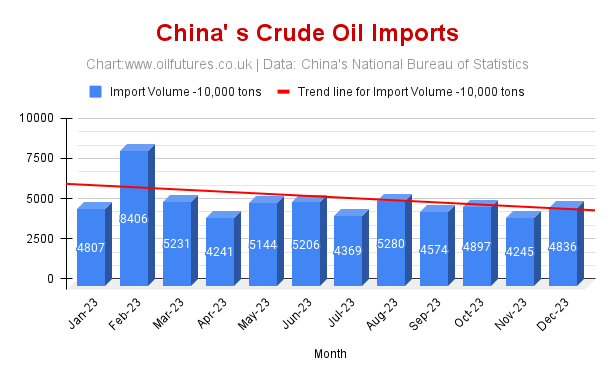

The data from 2023 clearly shows that China, the world's top importer of crude oil, is a factor that cannot be ignored when it comes to the stability in the crude oil markets.

The trendline, based on the crucial crude oil import volumes, shows a gradual, not a steep, decline in line with the fluctuating manufacturing activities. The trendline of China's Purchasing Manager's Index, PMI, followed a similar pattern in 2023.

There was a relative surge in crude oil imports in February on account of heavily discounted Russian oil after the war broke out between Ukraine and Russia. Both China and India cashed in on the unbelievable bonanza, defying international pressure, citing the domestic interests.

In August last year, there was a relative increase in the imports: In September, China's PMI, Purchasing Manager's Index that reflects the nation's manufacturing activities remained above the threshold - 50%.

Analysts, meanwhile, are awaiting the latest PMI from China for March this year to see whether it has gone above the crucial 50% mark; only three times in 2023, was it above the threshold in 2023 - in February, March and September. The crude oil imports in these months speak for themselves.

In another development, China's National Bureau of Statistics, said that the youth unemployment rate has gone up in February by 0.7%; the unemployment rate among the youth, aged 16-24, remains at 15.3% - a significant figure, indeed.

In the crude oil markets, meanwhile, there was a modest increase in the prices of oil, As of 10:30 GMT on Wednesday, WTI and Brent recorded $82.76 and $86.76 respectively. The price of natural gas was at $1.73. The US crude stocks have been falling for the past few weeks, according to the EIA, US Energy Information Administration.

Some analysts attribute the rising oil prices to the falling US oil stocks, implying a steady increase in demand. The long term trend, however, remains to be seen, because the demand - or lack of it - in China can still heavily influence the trend.

On political front, the mutual mistrust between China and the West, meanwhile, shows no sign of abating. On the contrary, it gets worse by each passing month.

The ban of TikTok by the US is a case in point. On this occasion, at least, China cannot hit back in kind! The US tech giants such as X, former Twitter, and Facebook have not been in operation in China for years.

With the banning of hugely popular video sharing app, however, the remaining tools for reviving - or salvaging - what is left of the relations between the world's top most economic powers are slowly heading to being redundant.

When the campaigning of the forthcoming US presidential election in November gets into full swing, the energy issue is going to be at the top of agenda for both parties, as the latter is the key factor that determines the inflation at present.

President Trump has already made it clear what his energy policy would be. In the coming months, President Biden will explain his position too.

Between the two ideological positions, the energy pendulum will oscillate up until November with the Chinese economic trends generating the unhelpful drag on the movements as the time elapses.