|

The GDP growth, according to the World Bank, meanwhile, depicts a mixed picture: the GDP growth that has been falling in recent years, suddenly showed a spike in 2021, only to fall back in 2022; it's an indication that just after Covid-19 lockdowns, China recorded an impressive growth, although it was short-lived.

The fact that oil prices remain static for a long period of time indicates how the investors take up the Chinese factor seriously, in addition to the interest rate hikes in the West and the change in crude oil stocks of the same bloc.

A fall in the US crude stocks, for instance, used to push the oil prices up while implying an increased demand; not any more in a noticeable way.

The frosty relations between the West and China, meanwhile, show no sign of abating. On the contrary, chasm in the trust appears to be widening that in turn helps neither.

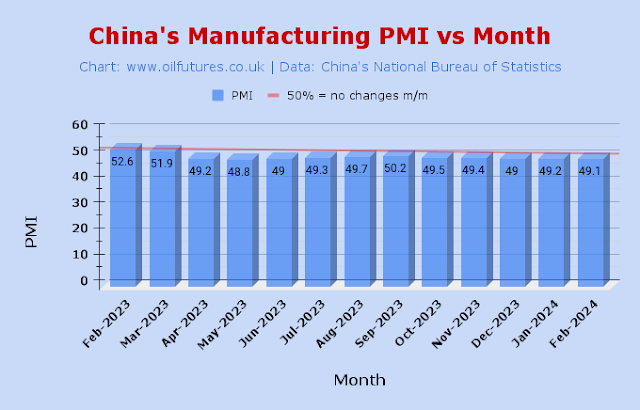

China may not buy oil from the traditional suppliers as much given its shrinking manufacturing activities. It, however, will not resist importing cheap oil from Russia, as it has underground and over-ground facilities for them to be stored.

Moreover, China has its own SPR - Strategic Petroleum Reserve - exactly like the US does; its location and size, however, are state secrets and China is not in the habit of updating the crucial data to the world for obvious reasons.

China, in the meantime, may be filling up the petroleum reserves with the cheap Russian oil as long as it can - and of course, getting away with it before being distinctly registered in the crosshairs of the West at some point in the future.

By doing so, it may not buy oil as much as it used to do from its traditional buyers in the Middle East on account of the relatively higher prices - a serious cause for concern among the investors.

As far as the crude oil prices are concerned, as of 16:00 GMT on 5 March, the prices of WTI, Brent and LNG, liquified natural gas, were at $78.48, $82.55 and $1.99 respectively.

|

| Chart & Data: www.oilfutures.co.uk |

When the data on the US crude oil stocks will be released by the EIA, the US Energy Information Administration, and the API, American Petroleum Institute, in the middle of this week, prices may fluctuate slightly more; they, however, will not remain that way for long - judging by the behaviour of charts in the recent months.

All in all, it makes perfect sense to go by what the EIA has forecast for this year and the next year, when it comes to the global demand of energy. The price of oil will follow a similar path unless a seismic change, political or otherwise, alters the status quo.