|

| Estimated Commodity Prices - Google |

With the war in the Middle East at a critical juncture, especially when it comes to the potential casualties of the beleaguered Palestinians near the Rafah crossing, bordering Egypt, Iran's desire to get involved in the conflict, if it had any before - apart from the Western estimates - appears to be on the wane.

Although the shipping route in the Red Sea is still vulnerable to the intermittent attacks by the Houthis from Yemen, the crisis appears to be manageable, as far as imminent dangers to the selected ships are concerned.

One of the obvious casualties in the Red Sea saga, apart from the shipping companies - and consumers worldwide, of course - has been Egypt: President Sisi of Egypt admitted today that his country lost between 40-50% of the revenue earned from the ships through the Suez Canal; many ships avoid the narrow waterway - and the Red Sea - not to risk the attacks by the Houthis; as the traffic plummeted so did the revenue for Egypt - when its own economy is in a dire state with its currency in freefall - losing its value by 24% just in 2024, according to Bloomberg.

Egypt neither took part in the so-called Coalition of the Willing nor complained about the potential revenue losses due to the turmoil in the Red Sea for political reasons; only today did it raise the issue of economic losses.

Perhaps the North African nation did not want to upset Iran by targeting the Houthis.

Iran, meanwhile, shows the signs of a well-calculated caution, having stuck to intense rhetoric for months to the contrary, in dealing with the war in the Gaza Strip; it is in no way a conciliatory move either. The theocratical regime of Iran is fully aware of its own domestic vulnerabilities in light of crippling Western sanctions that sow dissention among the young.

Iran, an arch enemy of Israel, issued a series of thinly-veiled threats against the Jewish state, defining its own 'redlines' for Israel not to cross, as the war broke out between Israel and Hamas. It, however, appeared to have realized the dangers in directly supporting some militants who operate in Iraq; Iran has been in denial over the direct involvement in the attacks on Israel on October 7, last year and of course, recent attacks on the US bases.

Arab media reports that a top general of the Iran's elite military force, IRGC-Quad force, in fact, visited Iraq shortly after the attack by the Iraq Shite militants on the US base that led to the death of three American soldiers. The reports further said that the general in question did ask the militant groups that Tehran has been supporting for years, not to attack the US and draw the blood of the US soldiers and face the wrath of the world's only Superpower - a bombing raid.

It seems to have done the trick; the Iraqi front has been relatively quiet since the massive attack launched by the US on the militants, followed by a targeted assassination of the leader of the group that is responsible for the attack on the US forces, in Iraqi capital, Baghdad.

In short, Iran is not hell bent on escalating the crisis, despite being no friend of Israel and the US; some sections of the Western media had been depicting the polar opposite in the past few months without reliable evidence in supporting the claims.

In light of the latest developments, the dangers to shipping lines in the Red Sea may gradually die down as the Houthis feel the pinch due to the US bombardments, having already being rebranded as a terrorist outfit.

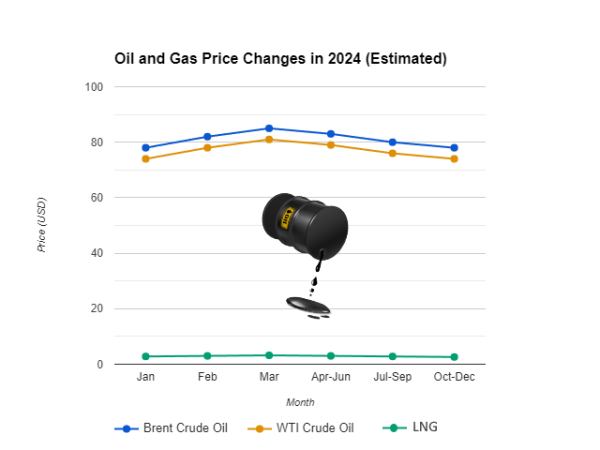

If the status-quo remains this way, the price of crude oil may come down again and enter a static phase once again - the familiar territory that it found itself in before the war in the Gaza strip broke out.

The short-term energy outlook of the EIA, US Energy Information Administration, meanwhile, does not see a spike in oil prices in the foreseeable future either.

The price of LNG, liquified natural gas, has, meanwhile, plummeted to record low - the worst in over three decades; with the cold season in the northern hemisphere coming to an end, the demand for the commodity is not to go up again until September this year. The net exporters such as Qatar may face difficult months ahead, if the fall in gas prices continues at this rate.

The stagnation of the Western economies - and some being in recession - has been blamed on the inflation that in turn robbed the consumers of their spending power.

The West, in this context, has to take measures collectively to pass on the benefits of the falling commodity prices to the businesses and consumers, if spending apathy is the root cause of the recession.

They cannot hold the oil producers in contempt for causing mayhem any more unless the governments make use of the tools at their disposal to ensure that the benefits of falling energy prices are distributed fairly down the energy pyramid.