The oil prices are in decline again despite the larger-than-expected draw in US crude stocks this week.

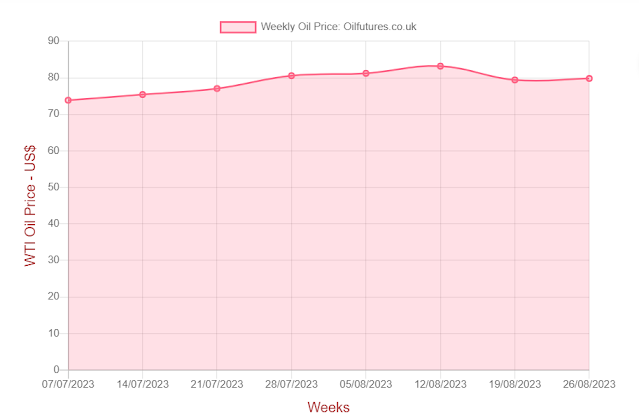

Although the production cuts announced by Saudi Arabia and Russia have been pushed up the prices of crude oil for obvious reasons, for two successive weeks the price of WTI has been below $80.

As of Friday 25 August 2023, WTI and Brent recorded $79.83 and $84.48 respectively.

Analysts attribute the fall in crude oil price to the stagnation of factory activities in China, Japan and of course, Europe.

As for China, the Manufacturing Managers' PMI, the key indicator that reflects the manufacturing activities in the world's second largest economy, has been below 50% since April.

In Japan, meanwhile, it has been reported shrinking manufacturing activity for the third straight month.

In Eurozone, manufacturing activity is in decline and it is particularly worrying in Germany, the workhorse of the blok. As for Britain, the economy is estimated to be shrinking in the present quarter.

In addition, the fear of further hikes of interest rates by the key global players such as the US, Japan and Eurozone leaves the investors cautious when it comes to taking risks while investing.

Of course, the global economy as a whole paints gloomy picture and it accounts for the stagnation of the oil prices that certainly were buoyed by the significant production cuts announced by Saudi Arabia and Russia.

As far as the US, the world's top oil producer and consumer is concerned, the rising oil prices during the past few weeks may have left the Biden administration in a difficult position, especially a few months before the next presidential election. The price of LNG, liquified natural gas, in the US has already climbed high and the administration cannot afford to let it happen on the oil front.

In the current circumstances, the only realistic option left for the US is to increase the supply as exactly done in the past. There is a challenge this time around, though: it is not easy to release stocks from the SPR, Strategic Petroleum Reserve, anymore as it is at an all time low right now. In fact, the US administration was contemplating filling it up, instead of releasing from it - until the prices of oil went up unexpectedly in July.

The US can beg of Saudi Arabia to increase the production using the leverage it has over the Kingdom, despite that not being very successful in the past. Alternatively, it can ease the sanctions on Venezuela and Iran so that they can flood the markets with their output, despite that being not politically palatable.

The other option left for the world's top user of oil is to turning a blind eye on the arrival of the Iranian oil to the international markets. Iranian oil minister, for instance, has already been on record saying that Iranian oil output in September will reach 3.4 million bpd in spite of the US-led sanctions.

As far as the non-oil-producing developing world is concerned, the price of oil below $80 a barrel help them enormously recover from three years of catastrophic economic decline in their quest for getting a foothold in the realm of global economic realm, defying hurricane-type headwinds.