|

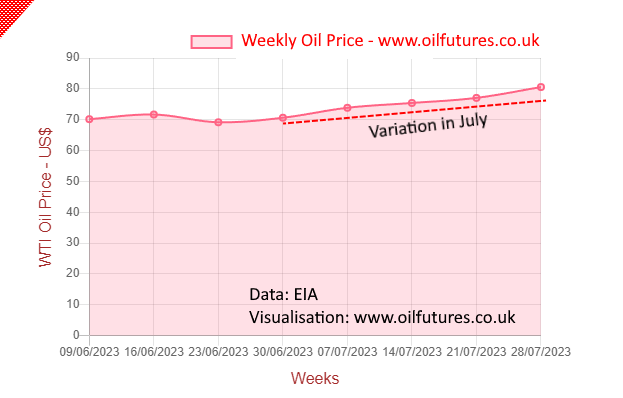

| Oil price in July, 2023 |

The price of crude oil rose almost by $6 this week, a development that can easily be attributed to the anxiety over the perceived shortage in supply due to the production cuts announced by Saudi Arabia and Russia.

As of 18:00 GMT on Friday, the prices of WTI and Brent were trading at $80.58 and $84.99 respectively.

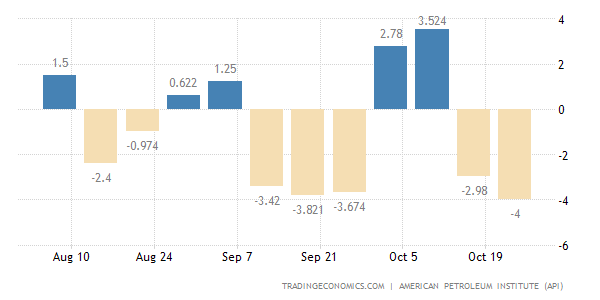

The US crude oil inventory data, meanwhile, stubbornly refuses to project any meaningful correlation between the crude stocks and the prices. It has been fluctuating, leaving the analysts high and dry for clues for months: if it is down in a certain week, it goes up in the next week or vice versa.

The inexplicable pattern has, in fact, resulted in doubts about the way data has been collected, analyzed and even using for future projections by the respective institutes in question.

The uncertainty in the crude oil markets got worse when Saudi Arabia and Russia said they would cut the crude oil production by 1.5 million bpd that is 1.5% of total global output in August. Understandably, a production cut of this magnitude can lead to a corresponding decrease in supply - at least in theory.

If the demand has not changed, up or down, in these circumstances, the price of crude oil should go up in inverse proportion. The issue, however, is the absence of any consistent evidence of demand picking up, due to prevailing gloomy mood over the global economic outlook that is far from rosy.

It is an undeniable fact that the rising energy cost was the most significant factor that threw a spanner in the works, when it came to recovering of the global economy, after the outbreak of Covid-19 in 2020. The oil producers did not take heed of the advice - or even pleas - by the consumer nations not to cut down on the production in order to boost the prices.

When inflation skyrocketed, the damage was universal - rich, poor or any nation in between. The oil producers were not immune to it either. The major producers such as the UAE and Saudi Arabia, for instance, were forced to hand out billions to their own citizens to address the issue of cost of living, because the two countries heavily rely on imports for the basic needs.

In this context, analysts are worried whether we are heading back to towards the same vicious circle. As far as the oil producers are concerned, especially Saudi Arabia and Russia, such an eventuality is going to be counter-productive in the long run and recent history is indisputable evidence.

The IMF, for instance, sheds light on the impending impact on the world's largest exporter of crude oil, Saudi Arabia. The global finance institution said on Tuesday that Saudi growth will slow down from 3.1% to 1.9% due to oil production cuts.

The projection is not rocket science: when you cut down on the production, you lose the revenues in exact proportion.

Of course, the production cost for Saudi Arabia is pretty high. The IMF estimated it to be just above $80 per barrel. That means, even at the current price level, the Saudis hardly make any profit.

Meanwhile, as far as Russia is concerned, there is no way of getting reliable data from it. Owing to the existing animosity between Russia and the West, it can even release data to pull wool over the eyes of the Western policymakers. Analysts, as the last resort, just rely on the tanker movements in at sea to estimate it - something to be taken with a pinch of salt.

The rise in price of crude oil will undoubtedly leaves the US, the world's largest producer and the consumer of the commodity, in precarious position, especially at a time, when the presidential election is just over a year away.

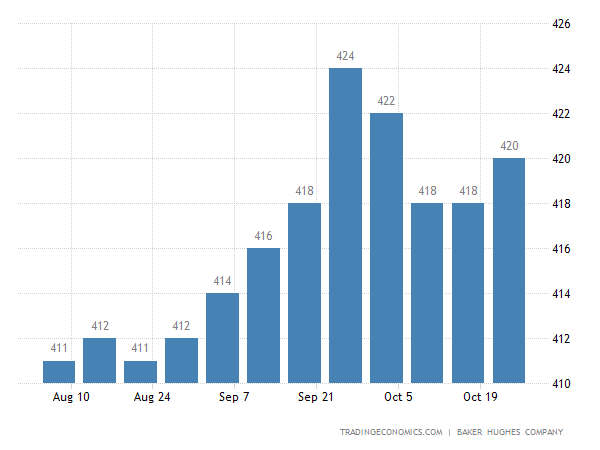

The falling rig count in the US, meanwhile, adding yet an additional headache to the US administration. That means the US crude oil production is a cause for concern and so is the supply.

On one hand, the relations between Saudi Arabia and the US have become frosty under the current American administration to such an extent that the US can no longer pressurize the old ally to increase the production of oil; on the other hand, the SPR, Strategic Petroleum Reserve of the US, has depleted so much that yet another round of release for stabilizing the oil price is neither gong to be easy nor feasible.

Influential political heavyweights, both Republican and Democrat, are in the opinion that the SPR must be replenished rather than releasing stocks from it, in order not to defeat its purpose - keeping oil stocks healthy for a rainy day.

In short, if the price of crude oil reaches an economically-harmful level, the US will be forced to respond. What sort of response that the US can take in order to keep the threat at bay remains to be seen, though.