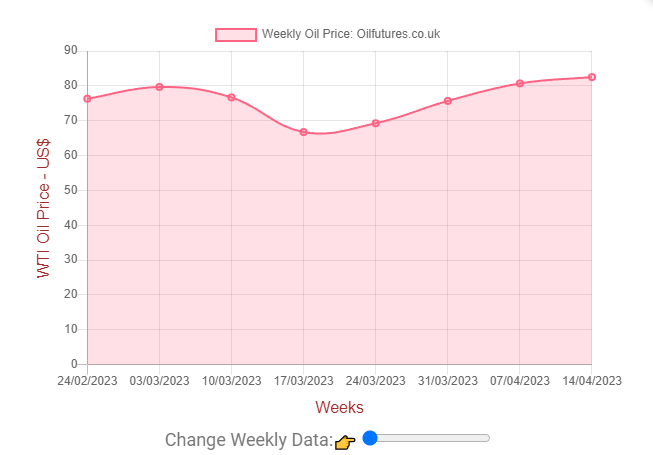

The prices of crude oil slipped into yet another statistically chaotic week as the latter draws to a close, having been through some wild fluctuations that defied reason.

As of 10:30 GMT, the prices of WTI, Brent and LNG, liquified natural gas, were at $77.36, $81.06 and $2.23 respectively.

Neither the fall in the US crude oil inventories, reported by both API, American Petroleum Institute nor the EIA, US Energy Information Administration, nor the encouraging GDP boost in China appears to have generated the desired effect - pushing up the price of crude oil.

On the contrary, it started falling on Thursday, heading towards where it had been during the past few weeks - virtually wiping out all the gains during the past few days.

The price of LNG, meanwhile, rose unexpectedly, something that has been attributed to the new cold front sweeping across the northern hemisphere. The unseasonal weather phenomenon is not here to stay in the region for long and the price of natural gas has already started falling in inverse proportion to the positive sentiment over the easing of the weather event.

With the gas prices at record low levels, the prices of crude oil are not going to experience a favorable upthrust at present from the former; the likelihood of industries leaning towards the former for cutting costs appears to be next to zero.

In addition, there is clear evidence that the US, world's largest LNG producer, is firing on its all cylinders, when it comes to the growth of the commodity. The trend partially accounts for the plummeting gas prices - in addition to the rising temperatures in the northern hemisphere, of course.

In short, there is plenty of gas in the international markets to be traded and the whipped-up anxieties over a supply crunch are already dying out much faster than those who instigated them thought, they would.

The repeated failures of commodity prices to break through the current price ceiling clearly show the present status of the global economy is not in good shape or form. If that was not the case, the demand for the fuels would have gone up significantly, while pushing the prices up.

In the US, meanwhile, the talk of replenishing the SPR, Strategic Petroleum Reserve, is gathering momentum once again. The Biden administration plans to go ahead with it in the fall. That means the administration hopes that the price of crude oil would go down further to such a level that the former can make realistic efforts to fill up the reserve.

The Biden administration has been releasing crude oil from the SPR in order to bring down the global crude oil prices, having failed to encourage the OPEC+ to do so; 180 million barrels of crude oil have been earmarked for the unprecedented move, despite being heavily criticized for tapping the reserve in conjunction with some allies that is meant to be for an emergency.

Analysts, meanwhile, are watching the next move by the OPEC+, as the latest production cuts announced by the group, did not do the trick. An imminent, aggressive production cut is highly unlikely, though, as the disadvantages on a global scale that stem from such a move clearly outweigh the immediate monetary gains.

All in all, the prices and oil and gas at the current levels help the global economy gather momentum for a sustainable growth, having been through unprecedented challenges.