|

| China's Crude Imports |

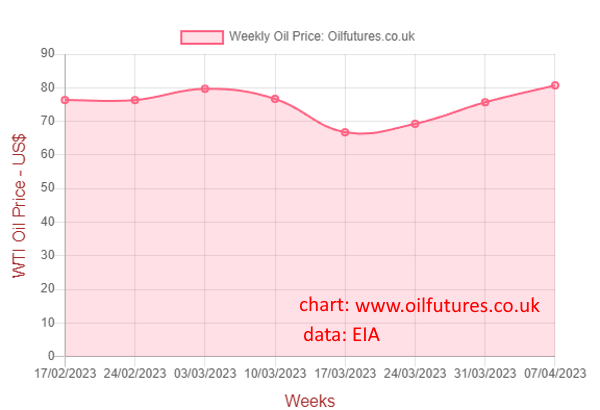

The move of production cuts made by the OPEC+, branding it as a 'precautionary measure' has not been successful in pushing the crude oil price up, apart from creating an understandable, initial stir in the markets at the beginning of the last week.

The failure appears to be consistent with the latest forecast by the EIA, the US Energy Information Administration, that simply says in its latest report, the commodity is in surplus in the markets at present.

The price movements in the crude oil markets, despite the cuts to be made in May and cuts already made by Russia, reflects the prevailing anxieties of the investors before dispensing their money; that means the global economic outlook is far from rosy, despite the fluctuating forecasts by the major, global lending institutions.

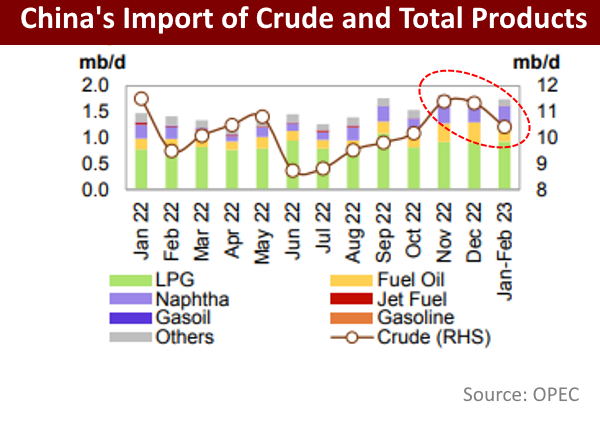

The crude oil imports by China, for instance, according to the OPEC, has gone down in the Q1 in 2023 and in India, the imports from Russia has plateaued: Indian media says the figure for March was 1.64 million barrels per day, becoming the largest supplier for the country, while accounting for a third of country's needs.

In retrospect, the ground situation, as far as the crude oil supply was concerned, had been correctly assessed by the OPEC+, when it abruptly announced a production cut - much to the dismay of consumer nations that do not produce the commodity.

In this context, the factory activities in China for March may have been the last straw for the major players of the OPEC+.

On diplomatic front, meanwhile, the chasm between the US and its allies in the Middle East appears to be widening: Shia-dominated Iran is finding a foothold again in the Sunni-nominated region, much to the discomfort of the US - and of course, Israel.

Having suffered from intense sanctions imposed by the US for years, Iran needs to kickstart its economy in order to address acute problems faced by its population. Since its main revenue comes from oil and gas, Iran may be planning to re-enter the energy markets as a legitimate player with the blessings of Saudi Arabia - and with the latter playing its leverage role.

The main stumbling block for Iran's reentry has been the suspension of the JCPOA - 2015 Iran nuclear deal - over Iran's ambition to produce a nuclear bomb, despite the latter's denial of doing so. It is ironic that even Saudi Arabia - and Israel for that matter - had been campaigning against the alleged move by Iran, up until China brokered a deal between the two most powerful regional foes in the region.

The way Saudi Arabia is going to help Iran achieve the ultimate goal, without reviving the JCPOA, however, remains to be seen - and explored; it is easier said than done.

Although cynics see China's mediation as driving a tight wedge between the US and its long-term allies in the Middle East, in fairness to the former, it just could be a move made in good faith in order to stabilize the political situation in the region before it is getting out of hand - and then making the existing energy crisis even worse; if that was the case, China, without much energy sources to fall back on, would suffer more than any other nation, being the world's second largest economy.

As far as the crude oil markets are concerned, how the OPEC+ is going to respond, when their revenues are going to be hit by the stagnation of oil prices, remains anyone's guess; up until the very day that they announced the production cuts, the cartel had been saying the exact opposite.

If they are forced to cutting down on the production once again at some point, the global economy that has suffered very badly due to rising energy prices, may find the recovery as illusive as a desert mirage.

With the relations between the US and the de factor leader of the OPEC+, Saudi Arabia, at its lowest in recent decades, there is not much room for maneuver for the former.

The release of oil from the SPR, Strategic Petroleum Reserve, may not remain an option for the US - for long; it is already at its lowest since 1983 and replenishing the stocks has not been realistic so far in light of high oil prices.

With a few months left before the US presidential election, the Biden administration will face a daunting task of controlling the high oil prices that could wreak havoc in the US economy.

The stakes cannot be higher for the Middle Eastern producers too; falling out with an economic and military Superpower, inevitably brings in a multitude of unwanted scenarios, especially when the former keeps its cards close to the chest.

HA