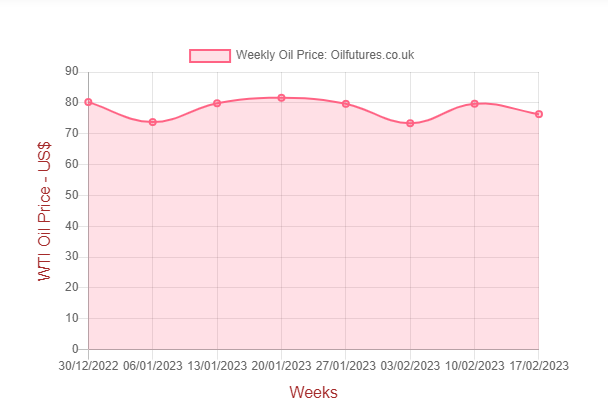

The price of crude oil has remained static during the first three days of this week, completely in line with the recent trend.

As of 16:20 GMT, the price of WTI, Brent and LNG, liquified natural gas, recorded $74.62, $81.31 and $2.19 respectively - hardly a significant deviation from the recent, respective prices.

The API, American Petroleum Institute, meanwhile, released its weekly data on the US crude stocks on Wednesday, which hardly is a catalyst for the struggling crude oil markets: the API said that there was a second, consecutive, massive crude build of 9.895 barrels - almost 10 million.

At the time of writing this article, both analysts and investors were awaiting the latest US crude inventory data from the EIA, US Energy Information Administration. Both the API and EIA reported a massive crude oil build last week, reflecting the prevailing consumer apathy.

If the latest data from the EIA confirms yet another crude build during the last week, it will deal a serious blow to the sentiment in the crude oil markets. It is highly unlikely that the data from EIA would contradict that of the API in this regard.

The price of LNG, liquified natural gas, meanwhile, keeps falling, defying the misplaced apprehensions that gripped the markets during the cold, dark winter months in Europe and North America.

As the countries in the northern hemisphere are heading to the spring, the weather factor is not going to be in favour of the gas prices. On the contrary, it will push the price further down and will be just a matter of time before the price crashes below the psychologically-sensitive $2 mark.

As of this week, the price of LNG has tumbled by almost 85% since its highest price in September, 2022. A fall of this kind will have a severe impact on the producers and traders alike in the coming weeks.

The combined effect of the relatively mild weather, ample stocks and the extensive supplies from alternative sources has created an atmosphere of hope among the consumers that is behind the fall in gas prices.

The falling gas prices, meanwhile, has become an inhibiting factor as far as crude oil markets are concerned; low gas prices do not force industrialists in the West to look for alternatives such as oil to run their factories that in turn keep the demand for oil at a manageable level.

In addition, on political front, the European governments can breathe collective a sigh of relief at the prospect of managing the energy crisis without emptying the coffers.

As for the steep fall of gas prices, the countries like Qatar, one of the top exporters of LNG, if not the largest, may find themselves in unchartered waters, as revenues start falling.

The cumulative effect of the falling oil prices is already felt in the Middle East: Saudi Aramco, which used to be the word's second most valuable company after Apple, lost its crown to Microsoft this week, falling to the third place. The stock markets in the UAE, United Arab Emirates, and Saudi Arabia have been falling as well, highlighting the worries about the falling oil prices.

Usually, when the price of oil falls, the OPEC, Organization of Petroleum Exporting Countries, tends to curtail the production on a whim.

Having learned the political consequences of such a move, the cartel does not seem to go down that road right now; the fact that both China and India, the world's second and third highest consumers in the world respectively, can turn to Russia for their needs without suffering the consequences of such a move by the West, may have made the Middle Eastern producers to understand the risks involved in hasty production cuts.

In addition, the US still has a trump card to play in the event of an unexpected hike in oil price - SPR, the Strategic Petroleum Reserve. The US, along with its allies, started releasing the crude oil from their SPRs, when endless pleas to the OPEC+ not to cut production fell on deaf ears.

When the US released 180 million barrels from its SPR last year, by coincidence, sheer luck or strategic impact, the price of crude oil did fall.

At home, however, the Biden administration came under fire over the move, as the federally-owned SPR is only for the use in an emergency, and not to stabilize the oil prices in the global markets; the failure to fill up the SPR, meanwhile, when it remains at a historic low, heaped more political pressure on the administration.

Despite all that, the US plans to release 26 million more barrels this year, guaranteeing a stable supply of the commodity in the markets.

In conclusion, it is fair to assume that the volatility in the energy markets has subsided to a reasonable level as the developed countries emerge from the winter. With that, the fluctuating intensity of war in Ukraine as a determining factor of commodity prices, appears to be paling into insignificance.

HA