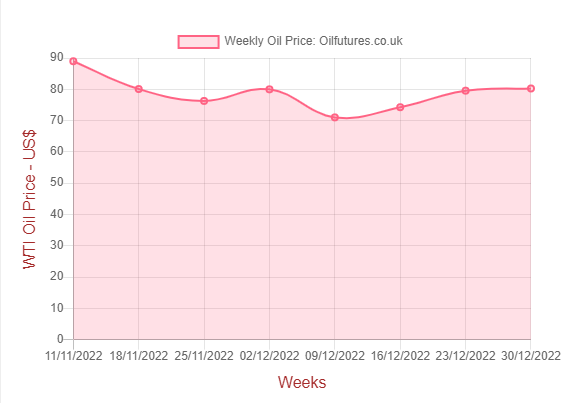

Although the prices of crude oil slightly recovered from the steady downward trend, it is unlikely to reach the economically-crucial $100 a barrel anytime soon, even by the predictions of the fierce optimists - and chartists.

The slight rise in price during the last few days, which is more of an anomaly than a spike based on hard facts, does not reflect the ground realities: it happened, for instance, when the US crude stocks showed a significant build; the manufacturing output in China, the world's second largest economy, continued to slide for four successive months; the price of LNG, liquified natural gas, has come down steeply despite the serious cold spells in the northern hemisphere; the global worry about a potential new Covid-19 variant is still looming large.

As far as the world's second largest consumer of crude oil is concerned, the latest data released by the National Bureau of Statistics of China clearly shows that the PMI - Manufacturing Purchasing Managers' Index fell from 48 in November to 47 in December.

The PMI determines the expansion or contraction of the Chinese economy by its 50-point mark; on that basis, as the above chart - based on the data from the National Bureau of Statistics of China - shows that China's economy has been steadily contracting for four successive months since September.

Of course, China has been on a collision course with the West for months. It is getting worse and the recent travel restrictions imposed on the Chinese travelers by some Western countries on account of Covid-19 outbreaks in the global manufacturing hub could be a potential tipping point on political front.

As far as crude oil markets are concerned, the outbreaks of Covid-19 in China are going to make a direct impact on the demand for obvious reasons: the logistics have already been disrupted; movements of the workers from factories to home and vice versa have been curtailed; prevailing negative sentiments hardly form a psychological catalyst to stimulate the supply-demand scenario.

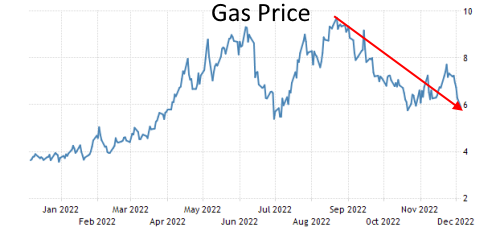

In addition, the falling LNG prices are not helping the crude oil markets recover the lost ground. on Friday before markets closed, the price of LNG was at $4.48, almost half of what it used to be about two months ago.

It is not just the relatively low price that rattles the energy markets. on the contrary, it is the fall in price despite the presence of multitude of factors that otherwise favour a steep rise which worry the investors: the supply woes stemming from sanctions on Russia; winter season in the northern hemisphere that naturally causes a steep rise in demand, to name but a few.

Despite two recent critical cold spells, both in Europe and North America, the temperatures are relatively mild again. That means three is no sign of the demand of natural gas increasing rapidly at present. When the price of gas remains low, manufactures will not choose to switch the mode of fuel-use for the cheaper, as happed during high gas prices that went above $9.00 in some weeks in the past.

All in all, the volatility of the price of crude oil shows no sign of abating in the New Year. The availability of the Russian oil for the 'loyalists' at rock bottom prices adds an unexpected dimension to the fast evolving trend - in addition to the one already added by the falling natural gas prices.