Judging by the reaction on impulse, the production cuts announced by the OPEC+ on Wednesday, has clearly left the Biden administration of the US between the rock and a hard place.

Not only did the US say that the decision was short-sighted, but also branded the move as 'the alignment of the OPEC+ with Russia'. The frustration of the US politicians over the move was palpable, indeed. it, more or less, transcends the political divide, which otherwise hardly see eye to eye on any other issue related to energy.

Perhaps, in order to calm the waters, the bigwigs of the OPEC+ appeared to have gone into a less-explicit-mode, when it came to the number-crunching during the press conference that followed the monthly ministerial meeting of the organization; we could only guess the actual cut - anywhere between 1.1 to 2 million bpd.

The announcement was a big blow to the US administration, especially when the mid-term elections are around the corner: on one hand, they decided to stop the release of SPR, strategic petroleum reserve after September, having been complacent over the recent fall of oil prices in the markets; on the other hand, the hastily made decision by the OPEC+ to cut the production took the US administration completely by surprise.

Adding insult to the injury, the Biden administration came to realize the Russian influence that played a vital role in cutting down on the production in order to shore up the falling oil prices that in turn helps Russia bolster its coffers - in the long run.

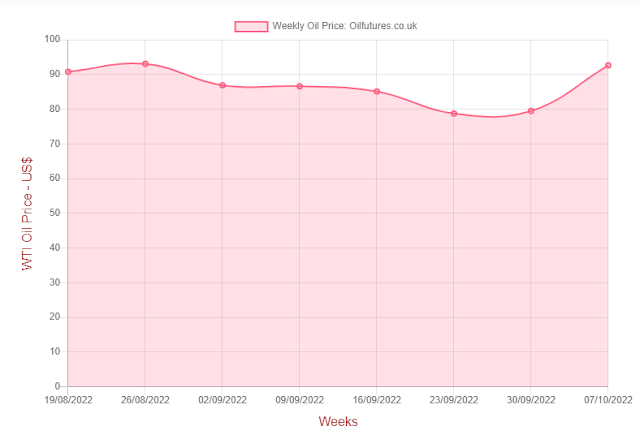

In response to the production cuts, the price of crude oil has been rising since the OPEC+ meeting: as of 15:15 GMT on Friday, the price of WTI, Brent and LNG, liquified natural gas, were at $90.14, $95.90, and $6.81 respectively.

That means, the price of crude oil at pumps will go up again and it hardly helps keeping tabs on spiraling inflation that damages the economy. In short, it is politically damaging for President Biden in the coming months.

The depleting SPR, strategic petroleum reserves, that is meant to be released only in an emergency is adding yet another headache to the US ruling party, although the move somewhat helped keep the prices at bay; of course, it needs to be replenished, as it is not a bottomless pit; it normally happens when the prices of crude oil is very low in the markets.

For instance, when oil price crashed in 2020, the US took the advantage of the falling oil prices and started filling up the SPR; India, China, South Korea and Japan followed suit.

At present, however, the prices are too high for such a move. In addition, there are obvious supply woes in the markets, exacerbated by the sanctions against Russian oil exports.

The rising oil and gas prices deprived the Biden administration of scoring a political goal due to falling oil prices: they hoped to associate it with the release of SPR.

Since the only way to bring the prices down is by increasing the supply in the markets, the US may release more crude oil from its SPR, perhaps in a more aggressive manner to 'teach' the OPEC+ lesson.

When the Biden administration first resorted to releasing crude oil from its SPR, it managed to encourage its allies to do the same: India, Japan, UK and South Korea joined the move by releasing crude oil from their respective SPRs in proportion their volume; even Chine, despite the political hostilities, decided to release stocks from SPR simultaneously.

This time, however, getting the allies on board is going to be easier said than done: in Europe, a major energy crisis in the offing and more often than not, the policy makers warn that the rationing of gas and blackout are inevitable in winter; in addition, getting India and China on board may not be easy either this time.

With the move of the OPEC+ that caught the US off-guard, President Biden made it clear that he would look for alternatives to bring the crude oil prices down, implying what he called 'other tools' at his disposal.

Analysts believe the resurrection of the NOPEC legislation that could potentially subject the members of the OPEC+ to antitrust lawsuits in the US on the grounds of manipulating oil price by production cuts.

Despite President Biden's recent visit to Saudi Arabia, there seems to be no diplomatic warmth between the two allies; By contrast, the Kingdom has gravitated towards the US foe, Russia, as a reliable ally - at least when it comes to controlling the crude oil prices.

Unfortunately, the recent US energy policy has been dependent on who occupies the White House and the two main Middle Eastern allies of the US, Saudi Arabia and the UAE, may have found it troubling to maintain the status quo at political and economic levels.

Saudi Arabia, meanwhile, responded to the criticism it received from the US over the production cut, while keeping the latter in the dark: in an interview with Fox News on Friday, the US news channel, Adel al-Jubeir, the Saudi minister of state for foreign affairs, said that the Kingdom did not politicise oil or oil decisions; he went to say the need of the US to do more to increase the domestic production in order to deal with the supply issue.

It is true that the US had been scaling down issuing new licenses to explore oil on federal lands as soon as the Biden administration came to power. Although, it reversed the decision later, the lands offered were kept to a minimum and the companies have been forced to pay more for the royalties.

The Saudi minister in question was referring to these decisions made on a whim by the US administration.

In the US, meanwhile, the anger is mounting against the production cut with some even calling for reviewing the defense ties between the the US and Saudi Arabia, something the latter cannot ignore for long.

The US has been instrumental in bringing about an uneasy truce between the Houthi rebels in Yemen and Saudi Arabia. If the US gets cold feet, the warring factions will be back to square one; the Houthis have been targeting Saudi oil facilities on the daily basis for months before the US brokered-truce came to effect. In an ominous move, Houthis refused to renew the ceasefire over range of issues.

In this context, the US-Saudi relationship is going to take a turn for the worse in proportion to the rising oil prices in the coming weeks.