China's manufacturing PMI, Purchasing Managers Index, rose by 0.4%, according to the National Bureau of Statistics of China, in August with respect to that of July, although it is still below the threshold, implying the economic headwinds that China encountered since June.

Despite the encouraging statistics as far as manufacturing is concerned, the Chinese media says that its Forex reserves dropped to $3.0549 trillion in August, something that is blamed on the surge in the strength of dollar and the depreciation of the Chinese yen and other currencies such as euro and the British pound: the reserves, the largest on the planet, have fallen by $49.2 billion since July, which is a drop of 1.58%.

China has been imposing random lockdowns whenever there is an outbreak of Covid-19 and sticking to a rigid Zero-Covid policy; although it successfully managed the spread of the disease, the steps have taken its toll on the economy; the Manufacturing PMI shows the impact on its economy in the recent months.

In line with the rising industrial activities, the power consumption has been steadily increasing in China as well. Although the growth of the world's second largest economy is far from what it used to be, there are signs it is back on track despite the recession fears in the West.

China - along with India - has been buying Russian oil and gas at an accelerated rate, much to the irritation of the West. The data from the National Bureau of Statistics clearly shows that the imports of gas, oil and even coal are on the rise as the cold, winter months are approaching.

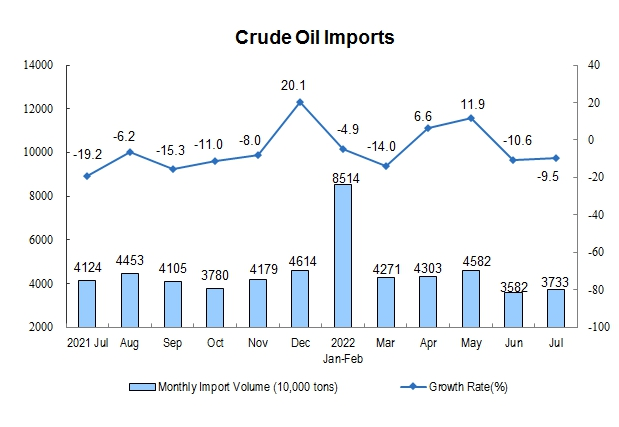

The crude oil imports by China suffered a significant drop in May when the former was forced to bring in lockdowns in major industrial cities in order to curb the spread of a critical outbreak of Covid-19. During the period of June to July, however, it slowly recovered, reflecting the success in keeping the spread of the infections at bay.

China's imports of natural gas have gone up as well since June; in May, due to the lockdown, it also clearly suffered a drop.

China's coal imports, however, have not been aggressive enough despite the perception to the contrary: last year, China was forced to look for coal sources as an urgent need, when there was a severe winter that in turn increased the demand for power; it even started cracking down hard on those who hoarded the commodity for excess profiteering that bordered on wanton exploitation in a national emergency; China, along with most global economic powers, finds it difficult to turn the back on coal as yet, despite the climate commitments made in public to do so due to obvious ground realities.

In short, China is still buying fossil fuels despite the economic challenges at home and geo-political challenges beyond its borders. In this context, the demand for the fossil fuels may remain relatively steady despite the recession fears across the globe.

Oil prices has been falling since markets opened on Thursday and as of 11:00 GMT, WTI, Brent and LNG, liquified natural gas, recorded $81.48, $87.52 and $7.79 respectively.

The substantial fall in LNG accounts for a similar fall in the price of crude oil, as the former decelerates the industrialists turning to crude oil as a substitute in order to keep the energy bills low - and survive.

The fall in price of LNG, despite the obvious supply woes that stem from the random Russian mischief making in the sector, is worrying for the investors. It implies that the fears of recession are not just impulsive.