With the inflation skyrocketing, the Western politicians have been forced to occupy the enviable space between the rock and hard place, when the spectre of recession appears just on the horizon.

The rise of interest rates and the inevitable sequence of events triggered off by it, do not make pleasant reading for those who hold the levers of power either: the Federal Reserve, for instance, resorted to the biggest rate hike since 1994; in the UK, the Bank of England raised the interest rate by 1.25% - the fifth increase in a row.

Amidst lingering uncertainty, the cost of fuels is on a steady upward march with no let-up: as of 09:50 GMT on Friday, the price of WTI, Brent and LNG stood at $118.50, $120.69 and $7.45 respectively - a steep rise by a few notches relative to what they were at the same time, last year.

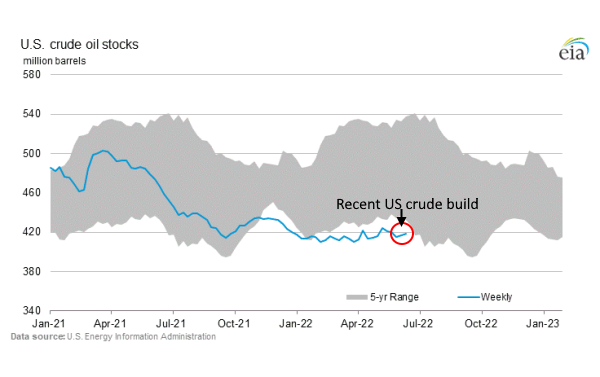

Neither the negative sentiments that echo the markets nor the modest US crude build in the past two weeks, brought down the price of crude oil as expected. On the contrary, it went further up, now even threatening the functioning of some European factories.

It shows the fact that the tight supply casts a long shadow over the crude oil markets, partially neutralizing the negative sentiments in the energy sector. Although the OPEC promised to increase the production, it has not materialized yet in order to calm down the fears over supply constraints.

In May, for instance, the cumulative daily output by the OPEC fell by 186,000 bpd, when the crude oil markets had been anticipating the polar opposite; in this context, many analysts are understandably sceptical about the latest promise made by the cartel to increase the production by 648,000 bpd for July and August.

In yet another disturbing development, in Libya, a string of closures, exacerbated by political unrest coupled with militant activities, have accelerated the near-collapse of its oil output; the political and economic situation in Iraq, a major producer in the Middle East, is not in a better position either, despite it being in debt to Iran, the neighbour, for supply of gas.

The failure to bring down the prices of crude oil - and LNG, liquefied natural gas - is already wrecking the economies worldwide, when they just recovered from a once-in-a-century pandemic; some countries still reel from it, when the rising energy costs added yet another unbearable burden on them.

As far as the US, the world's top oil consuming nation, is concerned, the repeated failures to bring down the price of oil at pumps have added tremendous pressure on the Biden administration; so far, every single attempt made in order to achieve it, much to their dismay, has miserably failed.

President Biden, perhaps as the last resort, now threaten the major oil companies with 'emergency powers' for failing to bring down the petroleum prices at pumps by increasing the output; the oil companies have not thrown in the towel yet, though.

On the contrary, some of them are hitting back: Exxon Mobil, for instance, dropped the placard of blame squarely on the doorstep of the White House, saying the inconsistencies in the energy policies are responsible for the debacle, not the conduct of the companies in question; they defended their handling of the issue by pointing at the vast investments they made in the sector in order to boost the production.

Amidst the blame - and counter blame - President Biden is planning a trip to the Middle East in July this year, with a stop in Saudi Arabia, the world's top crude oil exporter.

Although the White House says that the trip is not for begging of the Kingdom to play its role in stabilising the oil prices, analysts say they will be surprised if it was not the primary goal of the mission.

When the Biden administration took over the reins of power from President Trump, the relations between the Kingdom and the US took a turn for the worse: the media even reported that the Crown Prince of Saudi Arabia refused to take a call from President Biden at some point, when the latter put pressure on the former to boost the oil production.

Although relations between the two old allies have since improved, whether a high profile meeting in person can produce a meaningful outcome remains to be seen, if the primary goal is to persuade the Saudis to increase the production in order to bring down the sky-high crude oil prices.