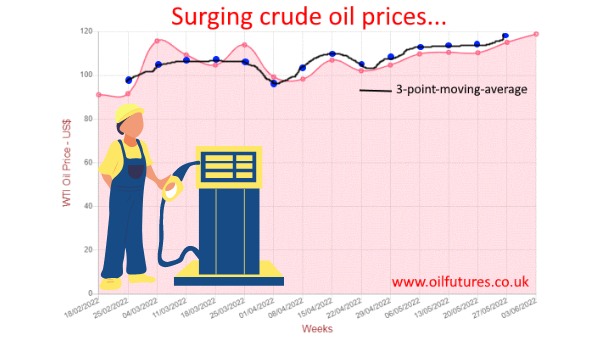

The price of crude oil is steadily rising and on Friday, the primary benchmarks, WTI and Brent, hit a record high at $118.87 and $119.72 respectively.

Neither the decision by the OPEC+ to increase the output by 648,000 bpd for July and August nor the fear of a global recession buckles the trend; as far as the OPEC+ is concerned the estimated figure, based on a previous group decision, for June remains 432,000 bpd.

The fact of the matter, however, is OPEC+ is still restoring the production cuts that it was forced to make, when the oil price crashed at the height of the pandemic in 2020, rather than increasing the net output.

In short, the rise in oil output, claimed by the cartel, is not sufficient to increase the supply in a dramatic way; the supply woes remain the same while the global consumption has already reached the pre-pandemic level.

Although economists have been warning about the impact on the global economy as a whole by the surging energy costs and the inevitable slowing growth, the politicians did not take it seriously as if there was no such risk.

Misplaced complacency over the state of the global economy, however, changed overnight, when a business heavyweight of Elon Musk's calibre chipped in, in order to warn that the risk was real, indeed and mimicking an ostrich was not an option.

The speed and the sentimental depth of President Biden response to Mr Musk's tweet show that the latter has struck where it really matters: the CEO of Tesla - and the world's richest man - warned on Thursday in a tweet that he had a 'super bad feeling' about the economy and wanted to cut 10% of the company's workforce while suspending the recruitment of new employees; his assertion also implied the sales of Tesla's electrical cars being affected in the long run, despite the absence of need of fossil fuels to power them.

Elon Musk is not the only tycoon that set the alarm bells ringing over the shape of global economy in general and the US economy in particular: the CEO of JPMorgan Chase and the president of Goldman Sachs also warned about a 'hurricane' just around the corner at a time when the US inflation hit 40-year high.

Amidst the intense criticism over the handling of the energy crisis, the US administration took steps to curb the rising oil prices, all to no avail: the collective release of SPRs, strategic petroleum reserves, backdoor threats to the oil producers and even the NOPEC bill, much to the frustration of the Biden administration did not do the trick; nor did the OPEC+ buckle under pressure.

Having chosen a square plug for the round hole, the US appears to be chasing after the major oil companies for not bringing down the prices at pumps; as a last resort, the latter are being singled out to be subjected to windfall taxes.

The measure has already been discussed in the United Kingdom and a fierce debate has sprung up involving the two camps: those who advocate the move and those who oppose - and of course, the influential oil industry.

It goes without saying that unless the upward march of the crude oil prices stops, the global growth will suffer during the second quarter, Q2, too; economists define two successive contractions of a given economy as the onset of a recession.

Since the war in Ukraine is about to enter a critical phase, the EU is under pressure to turn its back on Russian fuels - completely.

Although the alliance put on a united front, cracks are obvious and they can only get wider in proportion to the economic pain felt by the common people; it is not easy to find substitutes for Russian oil and gas.

All in all, the prices of crude oil will remain stubbornly high for the foreseeable future and the aspiration of them being stabilized in the near future is mere wishful thinking.