The price of LNG, liquefied natural gas, has gone up by over 100% since February this year and in the presence of such an increase, any hope of oil prices coming down at pumps just remains a distant dream.

We have been told, both by irrefutable statistics and reliable analysts, that a recession is more or less cyclic - almost like the seasons in the northern and southern hemispheres; it comes about at fairly regular intervals, not necessarily being associated with human activities - good, bad or outright crazy.

No expert, however, does say that the frequency of recession is entirely free from human activities; the recent forecasts of global economy as a whole grinding to a halt with a growth closer to zero is a case in point; in the realm of economics, two successive negative growths define a recession.

In a matter of 3 months, the gas prices have gone up by almost 100%. The invasion of Ukraine by Russia has made the situation worse with no end - politically, economically or militarily - in sight.

When Russia had been making the preparations for the war in Ukraine in the early part of this year, the West threatened the former with unpreceded sanctions, especially targeting its lucrative oil and gas sector; being true to its word, it has done just that.

At that time, Qatar, the world's top LNG producer up until recently, clearly said that the tiny Gulf nation could never be a substitute for the Russian contribution to the global needs; the West did not take heed of the warning.

In exact proportion to the supply crunch, the price of LNG has not just skyrocketed, but has gone exponential, resulting in a series of palpable economic shocks across the world.

The damaging development has spared none, whether the country in question is in the camp of developed nations or developing nations; the struggle that India, the world's third largest energy consumer, goes through in looking for affordable sources is case in point.

Even the US could not buckle the trend despite being technically self-sufficient in the energy sector, having transformed itself from a net importer to a reputable status of a net exporter, when it comes to fossil fuels; the prices of oil and gas in the US are a hot political topic too that does not reflect very well on the current administration.

The situation in Europe is pretty grim. The EU wants to be seen as a united block in turning its back on Russian oil and gas. The reality, however, is far from it; there is growing dissent among members to take such a drastic step without reliable alternatives. Hungary and Slovakia are in open revolt against such a move, while simply saying that they could not afford to take such a measure on a whim.

Russia has already turned the gas taps off for Poland and Bulgaria for failing to pay for Russian gas in roubles. Although, Bulgaria initially said that they could manage to find alternatives, the former now appears to be contemplating on paying for Russian gas in roubles.

The dilemma that the EU faces on energy front over Russian oil and gas has left Germany, the economic power house of Europe, in a very damaging lurch - both politically and economically - because the whole EU is waiting for the unequivocal German response on the issue; Germany, however, has been very vague about it since the war broke out, perhaps fearing the inevitable economic and social consequences.

The current high energy prices are not the only challenges faced by the EU at present: it has to shore up gas storages in the run up to winter and at these price levels, how they can address the consumer demands in a few months' time is just anybody's guess.

Although, the steep rice in gas prices has visually eclipsed the high petrol and diesel prices at pumps, the spiralling cost of living crisis shows the latter is very much in the crisis loop too, extending its ugly tentacles over many sectors.

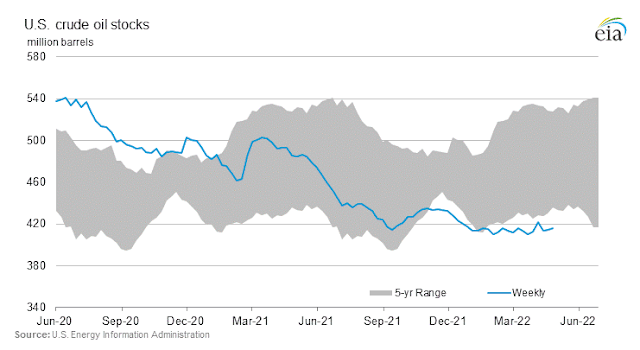

All in all, unless there is a significant, irreversible, downward trend in fuel prices, the so-called demand destruction will come into being - in the long run; the significant drop in the US crude inventories for the second successive week is a harbinger of what is in the offing.