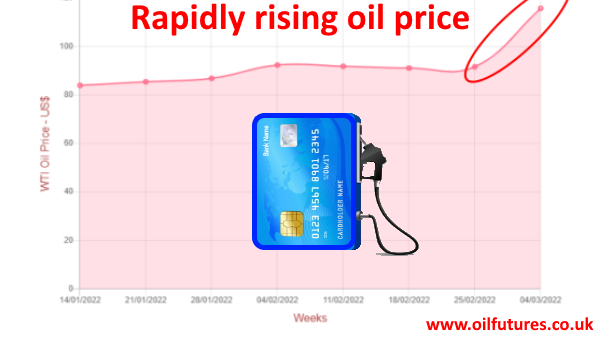

The price of

crude oil almost briefly touched $130.00 over the fears of a long drawn out conflict

between Ukraine and Russia. Although the Russian oil has not come under the

punishing Western sanctions yet, the speculation is rife that it will be the

next.

As of 11:45 GMT,

the price of WTI and Brent stood at $122.55 and $124.80 respectively; crude oil

prices have already reached 14-year-old high.

The price of

LNG, Liquified Natural Gas, has also spiked in proportion to the cautious

sentiments that sweep across the markets.

An extreme

move of that kind, however, does not come without a cost for the Western

economies; it goes without saying the impact of rising oil prices in every

sector in the global economy, ranging from the developing countries to the

developed countries.

Since the

OPEC+ has not responded enthusiastically to the anticipated shortage of crude

oil in the international markets in terms of an action plan, we can just

imagine how bad things would be in the event of the Western sanctions being

extended to the Russian oil and gas sectors too.

It is

equally puzzling how Russia would cope with such an eventuality; it already

views the sanctions as a form of declaring war by the West.

Without a

substitute in the offing, how the Western nations are going to cope with the impending

shortfall of crude oil supply is something that remains to be seen; when you look

at the challenges, just on the logistics-front, it is easier said than done.

The rapidly evolving

geopolitics since the war broke out in Ukraine will cause ripples in the OPEC+ too

in which Russia, not only a key member, but also sees eye to eye with its

de-facto leader, Saudi Arabia; the cohesion of the cartel may be under threat

too, if the West wants Russia out.

If the war

drags on, it is not just the OPEC+ that will be subjected to a stress-test; the

NATO, EU and even the UN will be under pressure too as the members do not see eye

to eye on quite a few issues; rising energy prices is potentially a key factor

that can cause unease among members.

Although the

price of crude oil has risen sharply, it cannot be classified as an exponential

rise as yet; it is still based on speculation in anticipation of a serious

supply shortfall.

The Western

leaders may try their best in a very difficult situation not to let the crisis

get out of hand – in a short time – that may evolve into a catastrophe, not

just ruining economies, but also threatening our own existence.