The price of crude oil fell on Thursday in light of

the second successive crude inventory build announced by the EIA, the US Energy

Information Administration, on Tuesday.

The EIA reported an inventory build of 2.4 million

barrels for the week ending January, 21. It is a significant build, compared

with the reported figure for the previous week - a modest 0.5 million barrels.

As of 16:30 GMT, the price of WTI and Brent stood at

$87.24 and $89.88 respectively. Earlier on, the latter even hit $91, only to

come down later.

The rise in crude oil price and that of natural gas

may be related to the ongoing conflict between Ukraine and Russia too. Russia

is a key player in the energy sector and analysts are watching President Putin’s

next move carefully in order to gauge the immediate impact on the markets.

The growth of the US crude inventories and the false

dawn about a breakthrough between the US and Russia relations may have

triggered off the fall in the crude oil prices, earlier on during the day.

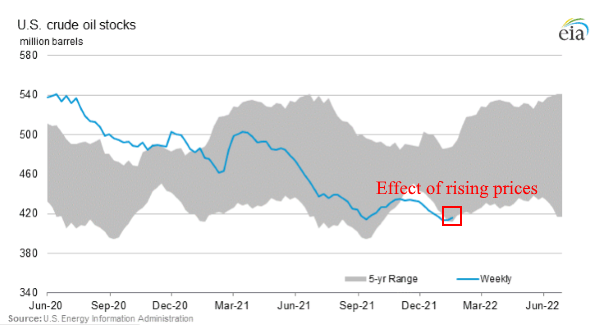

On the other hand, the rising crude oil prices have

pushed up the US crude oil in the past the above graph explicitly shows the

trend – once more.

The rising prices have brought down the consumption

and the fact the repeated release of SPRs, Strategic Petroleum Reserves, either

individually or collectively, have not been an effective, irreversible impact

on the price.

That means, the politicians are under enormous

pressure to get a grip with the crisis. What the former can do remains to be

seen.