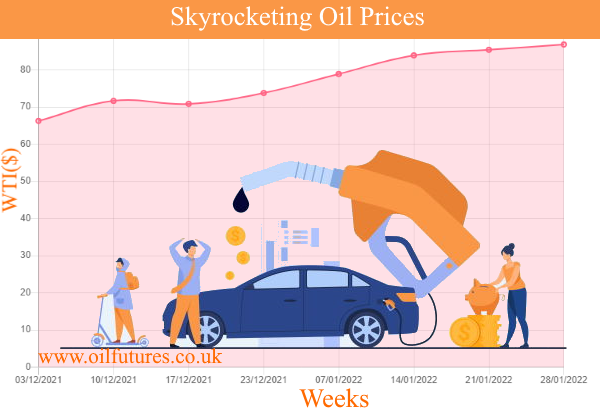

The rise of oil price continues unabated as the oil

producing regions experience serious political upheavals. The desperate measures

such as the release of SPRs, the Strategic Petroleum Reserves, did very little

to mitigate the impact on the consumer grievances in the face of rising

inflation.

The price of natural gas also spiked this week in

proportion to the intensity of the sound bites between the West and Russia;

Qatar, the world’s largest natural gas exporter until December, last year, has

already said that the former is not a substitute for Russia in the event of a

military conflict; having become the major exporter to the gas-starved Europe,

the US managed to claim the top spot recently.

The uncertainties have taken its toll on the prices

of the LNG despite the proactive intervention of the US.

As of Friday, 28 January, the LNG was traded at $4.614

per m3.

The rise in price of the LNG is adding an extra

weight on any hindrance that could potentially keep the prices of crude oil in

check; energy producers usually move away from the LNG for alternatives, when

the price of the latter goes through the roof.

In this context, the exponential rise in the price

of coal in recent weeks is indicative of the trend, despite its enviable

reputation of it being the ‘dirtiest fuel’ of all!

Bloomberg reports that the price of thermal coal has

risen to an all- time high - $300 per metric ton: Indonesia made the record

with the sale of small shipment while sticking to an existing export ban; the

export of the commodity can earn at least $ 244 per metric ton – the second

ever highest price.

The rise in price clearly reflects the fact that the

world is not prepared to ditch the commodity on a whim, despite the waves made

at the COP26 summit last year to the contrary; it’s simply easier said than

done.

The reality is neither India nor China has

alternative means to do away with coal at present; rising prices of oil, diesel

and the LNG make things worse for the Asian economic giants on energy front.

The rising price of crude oil is going to affect the

producers in the long run too: for instance, the OPEC share of oil imports by

India has gone down by 15% last year, despite 3.9% growth in the imports of commodity

during the same period by the country.

In addition, the rising oil prices are affecting the

US crude inventories as well; for two successive weeks, the crude build has

been continuing, according to the data released by the EIA, US Energy

Information Administration.

When the oil price was hovering around $70 a barrel,

the US crude inventories fell significantly; the data during the pandemic clearly

shows that they are negatively correlated: the higher the price, the greater

the inventory-build.

In these circumstances, markets slightly breathed a

sigh of relief this week, when Volodymyr Zelensky the, beleaguered Ukrainian

president, more or less, accused the West of ‘scaremongering’; the stand-up-comedian-turned

politician did not crack a joke, when he said the hype is costing its economy a

fortune.

Despite the calming reassurances by Mr Zelesnsky, the

tension between Russia and the West grows at a steady pace. A direct military conflict,

however, is highly unlikely as the stakes cannot be higher for both sides – and

the rest of the world that watches the drama passively.