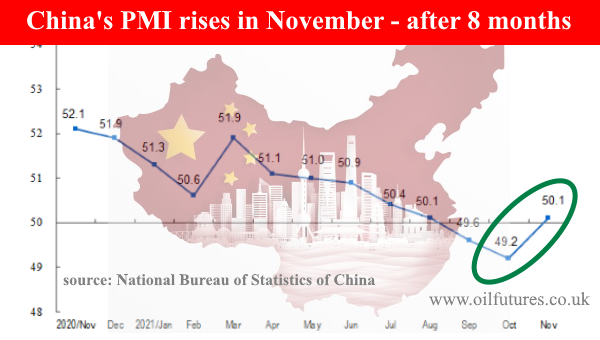

China’s Manufacturing Purchasing Managers Index, PMI, has

risen by 0.9 in November, buckling the downward trend of the past 9 months,

according to the latest data released by the National Bureau of Statistics of

China.

The encouraging news from the world’s second largest

economy will be a significant booster for the markets in general and crude oil

markets in particular, given the widely-predicted gloom in the first quarter of

2022.

China, along with the other major consuming nations,

resorted to tapping into strategic petroleum reserves, SPRs, in order to curb

the rising energy costs. China had been doing it even before joint move in a

controlled manner.

Although the impact on the crude oil price was next

to insignificance despite the collective move, the resurgence of the

Coronavirus did what the former could not do; it brought down the price of

crude oil by over $10 in a matter of hours since the gravity of the new wave of

the pandemic became clearer.

Although the OPEC+ stuck to their original plan by

promising to increase the output by 400,000 bpd, it made clear that there would

be an oil glut in the first quarter of 2022, vowing to take measures to safeguard

its interests accordingly.

In this context, the announcement by China about the

rise in its Manufacturing PMI, having been in the doldrums for over nine

months, could potentially be the much-needed silver line in the gloomy crude

oil clouds.

China suffered a critical energy crisis in September

and October as there was not enough coal to power up electricity generators,

leaving many regions without power. The cumulative impact had been felt by its industrial

heartlands too, which in turn exacerbated the economic growth.

Having come down hard on speculators and hoarders, China

finally managed to address the coal crisis, which in turn eased the pressure on

the global energy markets too, especially at the outset of cold, winter months.

The fall of gas price, perhaps, may, in part, be due

to the successful handling of the energy crisis by the communist nation – with the

iron-fisted approach, of course.

If the price of oil crude oil remains at the current

level, without going through the roof, China will resort to importing it in

proportion to the growth of its economy.

This will in turn boost the coffers of oil producing

nations too in the short term, as their long-term fortunes are at the mercy of

the progress made in the global renewable sector, something way beyond their

control.

The right price for crude oil is important for both

producers and consumers – for mutual survival; rising energy prices have triggered heightend the inflationary pressure almost in every nation, inclduding those of the OPEC+.

In the UK, for instances, the Office of National Statistics, has given the follwing updatef ro October:

If oil producers suffer, as it happened at the

beginning of the pandemic, the impact will be felt far beyond the geographical boundaries

of the producers, especially in the Middle East; the health of these economies

determines the livelihoods of millions of less-fortunate people in Africa and

Asia – directly.

Although the new variant of Covid-19, Omicron, is

worrying, the major oil consuming nations such as the US, Japan and India are

showing encouraging growth prospects. It may dampen the gloom predicted over

the crude oil markets slowly – defying the worst.