Oil price fell slightly this week, having been

through unprecedented uncertainty. It, however, neither fell disastrously nor

increased dramatically due to outbreaks of the Delta variant of the Covid-19

and projected recovery in global demand respectively.

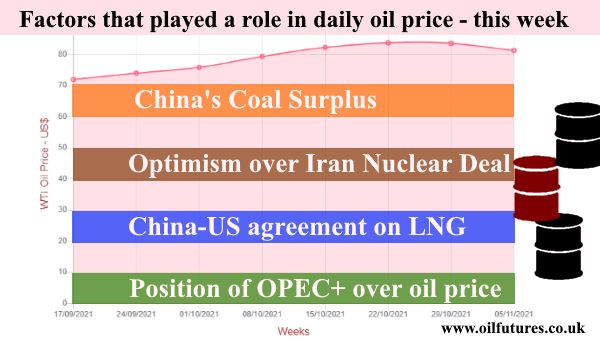

The sole focus of attention was on the OPEC+ meeting

that ended on Thursday, November 4.

Almost everyone in the crude oil realm expected that

the OPEC+ would not be able to ignore the pressure from the main importers such

as India and Japan and of course, the US; the hope for a positive outcome, as

far as consumers are concerned, got a boost when President Biden waded in

personally, but to no avail.

Analysts anticipated some ‘retaliatory’ measures in response

to official OPEC+ snub; they expected, for instance, a substantial release of the US Strategic

Petroleum Reserves in order to calm down the crude oil markets. It, however,

did not happen.

On the contrary, the US approved a significant sale

of military hardware to Saudi Arabia, the de facto leader of the OPEC+, which

often pulls the strings when it comes to the key decision making in the cartel.

As far as the so-called energy crunch is concerned,

President Biden is currently at an uncomfortable position between the rock and

the hard place: on one hand, he, unlike his predecessor, is committed to

achieving green goals – and even carrying the can for the global awareness; on

the other hand, ignoring whom he referred to as ‘working class Americans’ is politically

suicidal in the middle of rising energy costs.

The timing of the multiple developments is hardly

helpful for President Biden either, especially when the COP26 is underway in

the United Kingdom.

In short, he has been forced to walk the tight rope

of energy management in light of unforeseen developments; he, perhaps, did not

anticipate a critical crude oil supply issue of this magnitude, exacerbated by

gas shortage – as well as coal.

The rising oil and gas price is affecting every

citizen of the globe, not just the US consumers or those in the West at present.

In this context, political analysts wonder why President Biden just referred to

the hardships faced by the working class Americans, without bringing the rest

of the inhabitants of the planet under the same canopy.

Is it just a slip of the tongue? It, however,

survived the intense media scrutiny that the President Biden is usually

subjected to.

In China, meanwhile, the authorities are confident

that the coal shortages are behind them now with coal refineries being in

healthy surplus.

That means the pressure on the gas markets from the

world’s most populous nation on the planet will not be as bad as it was in

October.

The US crude oil inventories, in the meantime, grew

yet again this week – for the sixth successive weak. Crude oil price did not

respond to this news, though – a sign of inventory fatigue.

In another development – or a twist – China and the

US companies have signed a deal for the former to import LNG from the latter

for 20 years, dealing a heavy blow to Australia, from which China used to

import the commodity; according to reports, the LNG imports by China from the

US has skyrocketed in the past few months, exceeding 300% - at the expense of

Australia in the middle of political tension between the US and China, of

course.

When the US could not get what it wants from the

OPEC+, the discussions on the JCPOA, 2015 Iran nuclear deal have started

grabbing headlines again. Iran says they will start on November 29.

There have been false starts during the past few

months, especially under the new Iranian administration, though. Since three weeks is a long time in

geo-politics, we have to wait and see whether it will start this time for sure,

especially in light of fierce opposition to the deal in its current form from

the Gulf Arab states and Israel.

Iran, on its part, may take the advantage of the

existing fuel shortages to make it work in its favour, because the country is

in a dire economic situation, getting worse by the US-led sanctions.

If the sanctions are lifted, the impact on the crude

oil market will be huge, especially in the middle of an energy crunch.

Despite the optimistic overtures, the US and Iran

are still at diplomatic war. In this context, the start of the talks, let alone

the success of the outcome of the JCPOA, will be determined by rapidly-evolving

verbal spats between the two nations.