There is no sign of let-up in the global energy

crunch as of this week, as the chaos in supply chains grows unabated alarmingly.

Long standing, sometimes running centuries back, political rivalries hardly

help alleviate a catalogue of crises stemmed from the same problem that needs

collective global action.

The bone of contention between France and Britain

over a range of issues, not just one, is a case in point; the French even threatened

to cut off the electricity supply to the latter from the former at the heat of

the argument.

In addition, the diplomatic tussles between the West

and Russia do not help get more gas into Europe at its hour of need either.

Analysts argue that the European nations were too

complacent about the potential contribution to the respective power grids by

the renewables, especially wind. Much to their dismay, however, there were

unusually long static periods in the atmosphere above the regions, where there

are heavy concentration of wind turbines.

Despite the availability of modern technology to

acquire many forms of data – and machine learning / AI algorithms in equal

measure to crunch it – the industry does not appear to have seen this coming.

When they realized the gravity of the challenge, it

was far too late: having turned the back on coal power, the authorities

scrambled to find substitutes that resulted in turning to gas. The sudden,

unprecedented demand, completely in line with basic economics, led to an

increase, both in demand and of course, price; when gas prices shot up, they

turned to the next available alternative, crude oil. Then it went up too,

despite the projected global demand being a matter for debate.

For instance, the latest US crude inventory data from

the API, American Petroleum Institute, shows an inventory build-up for two

successive weeks; the latest figure, released on October 13 for the week ending

October 10, shows a significant build-up of 5.213 million barrels, when the estimated

figure was just 0.14 million barrels!

The corresponding data from the EIA, US Energy

Information Administration, is expected today. Last week, the EIA also indicated

a crude inventory build-up.

The OPEC+, meanwhile, downgraded its own previous

forecast for demand, signalling a decline in the short-run. It, however, says

its forecast for 2022 stands as it is.

In China, meanwhile, the authorities are confident

that they can start the production of coal again for its power sector, hampered

by the recent floods; floods have receded much faster than they anticipated and

they are confident that they can get coal plants up and running soon.

The optimism of the Chinese authorities will ease

the pressure on demand for the commodity in the international markets. China,

however, has already turned to other sources for more coal imports such as

Russia, Indonesia and Kazakhstan.

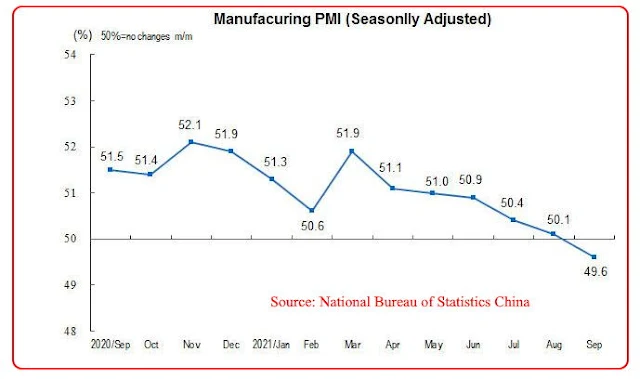

The power shortages, however, have taken its toll on

the manufacturing activities of the world’s second largest economy. According to

the figures released on October 13, the Manufacturing Purchasing Manager’s

Index, PMI, a key index, has dropped in September by 0.5% of what it was in

August, 2021.

China has been complaining about the impact on the manufacturing

sector by the rising prices of raw materials for the past few weeks, an issue

clearly exacerbated by rising fuel costs.

Despite the need of the hour being the an increase

in production of the oil and gas, India, meanwhile, failed to attract investors

for 21 oil and gas blocks in its latest bid to auction them: there were just

three bidders, two of them being the state companies. The development shows the

lingering concerns of the investors about getting involved in the sector.

The IEA, International Energy Agency, meanwhile,

wants the world to invest more in renewables; the agency, partly being

responsible for discouraging investors from using their money on the investment

of fossil fuels, wants government to increase the power production by the

renewable sources.

The IEA, however, clearly identified the main

roadblock against its ambition this time – lack of money. Will the die-hard

investors of fossil fuels switch the allegiance in droves to the clarion call? It

remains to be seen.