Amidst the growing concerns about the short-term availability

of fossil fuels that the world is so eager to ditch unceremoniously in few

years, the focus of attention of the crude oil markets is on the OPEC+ meeting

scheduled to be held today.

Apart from those who are infectiously fond of the renewables,

the rest partly blames the crisis on crude oil producers and when they say it,

OPEC+ is usually on their radar.

Blaming it on OPEC+ alone, however, like accusing

the picturesque celestial giant, the Saturn, of polygamy, just because it has

many rings.

The current crisis does not just stem from lack of

production; it’s the accumulation of a multitude of factors which were not

taken seriously by the decision makers in time: the distribution issues, heavy

local taxes and petty regional politics to name, but a few.

In this context, the OPEC has become the convenient

scapegoat when there is a herd in a metaphorical meadow that determines the

price fluctuations of the vital commodity.

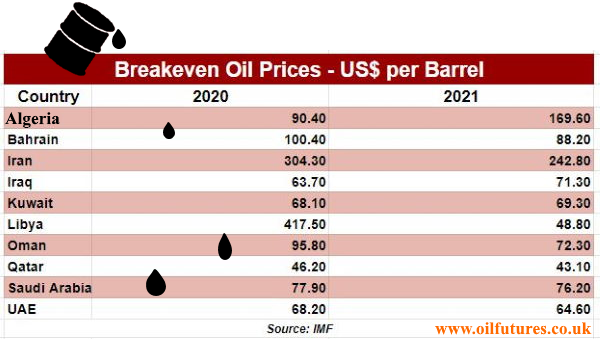

One of the things that the critics of the cartel

overlook is the evolving realities of breakeven values of each major producer;

there is no universal value even in the same region, determined by a catalogue of

factors.

On the part of OPEC, however, it has not been very successful

in presenting its side of the story, let alone fighting back.

At present, on one hand, the price of crude oil is

high for both the developed world and the developing countries, especially when

they try to make a collective recovery from the pandemic. On the other hand,

with the winter months ahead, there is no evidence to feel that the pandemic is

really behind us.

In this context, helping the global economy recover

and maintain the momentum is everyone’s interest – both producers and consumers

– because, we are not out of the woods, as yet.

The current situation in New Zealand is a case in

point: it had one of the toughest lockdown on the planet, a virtual isolation

from the rest of the world with rigid border closures and strict quarantine

measures, yet the challenge remains with no sign of perfect recovery on the

horizon.

As for the OPEC+, unlike they were on the previous occasions,

the meeting of the technical committee and that of the ministerial are going to

take place on the same day.

Analysts, meanwhile, are wondering whether the early

intervention of Jake Sullivan, the US National Security Advisor will make any

difference at today’s meeting of the OPEC+. In the past, the US chose to make requests

to increase the production of crude oil at the eleventh hour.

In addition, they wonder whether the intervention of

a senior security official of the US administration is an attempt to link the

increased production of the crude oil with the security of the de factor leader

of the OPEC+, the Kingdom of Saudi Arabia.

Recently the US withdrew the air defence system,

along with the Patriotic batteries, when the Kingdom is urgently in need of it,

when the latter has been at the receiving end of drones and missile fired up by

Houthis across the common border between Yemen and Saudi Arabia; it has become

a daily event these days.

In this context, it is likely that Saudi Arabia will

be instrumental in making its traditional, powerful ally happy by agreeing with

its demand. It, however, will be challenging for the Kingdom to take every

member of the OPEC+ on board in reaching a collective agreement.

In short, the stakes cannot be higher for Saudi

Arabia, when sandwiched between its urgent needs of security and organisational

responsibilities of a powerful cartel.