Oil price remains fairly buoyant despite the ripple

effect of the new variant of the Coronavirus that almost drowned the hopes of

the efficacy of the vaccines that grab headlines.

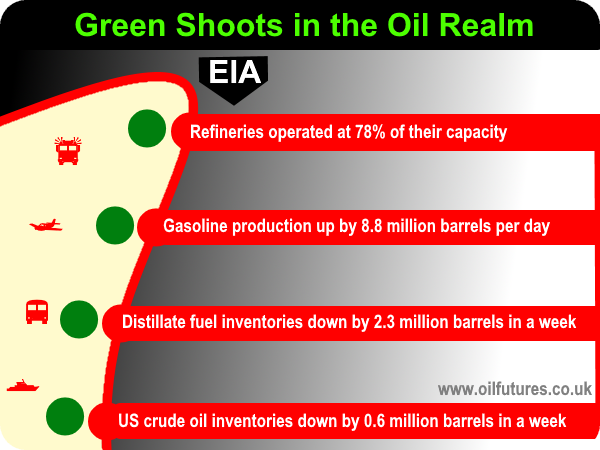

The latest data released by the EIA, the US Energy

Information Administration, sheds light on the unexpected phenomenon.

In fact, as far as oil markets are concerned, the

data is pretty encouraging.

Both crude oil inventories and distillate fuel inventories

are down for two successive weeks, up until December, 18. Gasoline production,

meanwhile, is up too against the odds. The other encouraging news is that the

US refineries work at 78% of their usual capacity.

The latest data from the EIA comes in the wake of

positive news about the steady demand in Asia for the commodity.

In addition, the discoveries of new oil fields,

especially in Africa, further enhances the investor confidence that in turn

makes the sector grow with an irreversible emphasis on the need of cutting down

on the pollution.

Investors know that fossil fuels are here to stay

for decades to come even if the demand may never turn exponential again; as

this is the truth, they are not prepared to abandon the sector and embrace the

green equivalent – as yet.