Oil price has been seesawing worryingly in the last

few days, reflecting the volatile nature both in the political and economic

realms, partly being shored up by the pandemic and the possibility of its ‘second coming’.

The demand has been very low and it’s understandable

in the current circumstances.

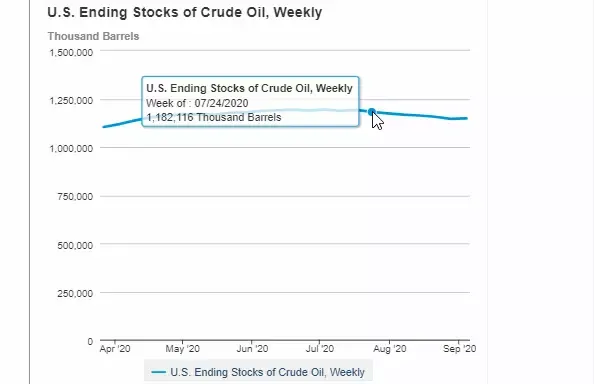

Analysts, however, appeared to have overlooked a significant

factor that the EIA, the US Energy Information Agency, identified that

determines the oil price – the oil inventory build-up.

The EIA said on Thursday that US crude stocks rose

by 2 million barrels a day when the analysts estimated a drop of 1.3 million

barrels a day – a strange reversal of figures – in the week leading to September

4.

The EIA particularly blamed the rise in stocks on Hurricane

Laura that hampered the activities at the refineries. In addition, the weak

demand in jet fuel and gasoline contributed to the surge in stocks.

You can view all the latest charts that matter here: