Hurricane Sally, which was downgraded to Category 1

on Tuesday, slowly makes its inward journey, causing serious flooding in the

region around the US Gulf Coast.

Although it lost its strength in terms of destructive

speed, it brought the oil and gas production in the crucial region to a partial

paralysis; it is estimated that more than a quarter of production was shut

along with the export ports.

Understandably, oil prices recovered slightly

perhaps based on the temporary disruption to the production and distribution of

oil and gases in the region.

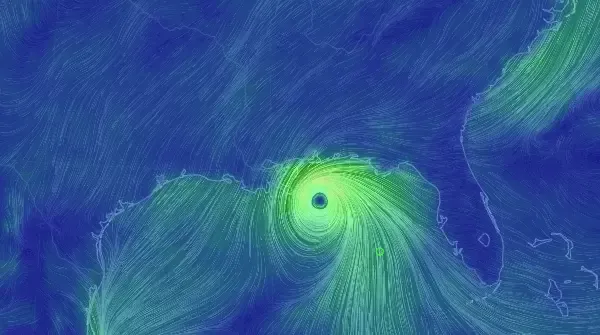

The weather data, meanwhile, shows the formation of

another potential storm, far away from the US East Coast in the region. Its

path and strength in the coming days is anybody’s guess at present, because

these storms can never be modelled with 100% accuracy despite the availability

of vast amount of data and the tools to analyse it.

Evolving weather patterns are not the only factor that

the analysts keep focusing on at present. Although oil prices have stopped fluctuating

wildly since the peak of the pandemic, there are many factors that need to be

watched in the coming weeks in order to gauge their impact on the price.

For instance, there are signs that Iraq and Libya to

get their production back on track. It comes at a time when there is clear

evidence that the oil markets experience a supply glut.

Since the world is handling the second wave of the pandemic

reasonably well, things on many fronts will improve defying the gloomiest

forecasts of the global economy.

Since the rekindling of Arab-Israel relations always

plays a constructive role in the highly-volatile region, the probability of a

major production inhibition is becoming low in the run-up to the US

presidential election.

All in all, the oil markets will maintain its

recovery in the coming weeks and it’s good for the industry, millions of people

whose livelihood directly depend on it at an uncertain time.