Oil price is on the rise again at the news from the

EIA, the US Energy Information Administration, that the US crude oil

inventories are on decline for the past few weeks and it remains to be

consistent for a significant period of time. That means the US road traffic is returning to

normal at a stea…

Wednesday, 30 September 2020

Monday, 28 September 2020

Oil price gains stability: this is a key factor!

Oil price regained its position just over $40,

despite the gloomy forecast about a prolonged bearish trend in the light of the

second wave of the coronavirus pandemic. It’s undeniable that the infections are on the rise,

especially in Europe and to some extent, in the rest of the world too. Unlike d…

Sunday, 27 September 2020

Will the oil price come out of the bearish territory? The answer is, 'firm yes.'

Oil price is in bearish territory again, perhaps

owing to the fresh outbreaks of coronavirus infections in Europe. The new infection rate in the US, the world’s

biggest consumer of oil, still poses a serious worry as far as oil markets are

concerned. China, the second largest consumer has kept the …

Thursday, 24 September 2020

Inventory draws and supply constrains will stabilize oil prices - EIA

The production cuts by the OPEC+, coupled with continuous

inventory draws, are going to stabilize the oil prices according to the latest

report by the EIA. Based on the latest forecast, the stability may be

already in the markets, which is often shadowed by unusual daily fluctuations,

triggered by s…

Wednesday, 23 September 2020

US Oil Exports are on decline since the Covid-19 Crisis

Global oil prices are to seesaw around $40.00 a

barrel for some time owing to yet another supply glut. The EIA, the US Energy Information Agency, reports a

steady decline in US exports since February, which can only indicate a fall in global

demand in proportion. Since producers are beginning their a…

Monday, 21 September 2020

Making hay while the sun shines: India saves millions of dollars by buying on the cheap

India saved more than 685 million US dollars by going on an accelerated buying spree during April-May period, while cashing in on the record-low oil price. Accoring to petroleum minister of India, the country managed to store the crude oil in underground, strategic oil storage facillities. With that,…

Saturday, 19 September 2020

Oil Price: upward momentum noticed at the weekend

Oil prices continue to soar as the markets

approached the weekend. The slight reduction of the US oil inventories may have

played its usual part in stabilizing the price. At present, there are signs it may stay bullish for

now. There are a few scenarios that may decide the rate of recovery, especial…

Friday, 18 September 2020

Hurricane Teddy: new threat to oil supply and distribution in the Atlantic

Hurricane Sally fizzled out without causing the anticipated,

dreadful destruction along the US Gulf Coast. The mood of relief, however, has been dampened by the emergence of the new

threat that is developing into a Category 4 hurricane – Hurricane Teddy. It may make landfall on Tuesday if the predic…

Thursday, 17 September 2020

Ripples caused by BP Oil Outlook 2020

The shocking announcement by the oil giant BP that

the oil would never recover to the level that the markets were aspiring for,

was the last thing that the producers wanted to hear in a turbulent time. The producers, mainly the OPEC, did not try to

dampen the pessimism. On the contrary they added fu…

Wednesday, 16 September 2020

Oil Price Slightly Goes Up: Hurricane Sally causes production and distribution disruptions

Hurricane Sally, which was downgraded to Category 1

on Tuesday, slowly makes its inward journey, causing serious flooding in the

region around the US Gulf Coast. Although it lost its strength in terms of destructive

speed, it brought the oil and gas production in the crucial region to a partial

para…

Tuesday, 15 September 2020

Oil Price: the long road to recovery and green shoots

The traffic

data gathered by Reuters, based on TomTom traffic indicators, clearly show an

upward trend in traffic in London, Paris and New York. People use private

vehicles to move between cities and towns for their needs, which could boost

the demand for gasoline. Although it’s

a positive factor in…

Clear Evidence that Fossil Fuels are Here to Stay...

The EIA, US

Energy Information Agency, says in its

latest report that fossil fuel, including petroleum, natural gas, and coal, formed

the largest share of energy production and consumption in the United States,

the world’s top fuel user, last year. In 2019, it

was staggering 80% of domestic energy pr…

Monday, 14 September 2020

Recovery of Oil Price and Keeping Covid-19 at Bay are Linked - the logic is simple!; it's individual civic responsibility

We

may not be out of the woods yet, as far as the once-in-a-century pandemic is

concerned. The

world, however, had witnessed the worse before and managed to come out of it. In

1918, the Spanish flu was a case in point: it affected over 500 million people

and around 10% of them died with enormous suff…

Sunday, 13 September 2020

US oil rig counts fell this week

The oil rig count in the US fell by 2 this week, according to weekly data from Barker Hughes on the subject. It may seem a small number at first; however, when you take into account what the rig count was this time last year, it's a serious matter for the industry, which is already at the epicen…

Saturday, 12 September 2020

Factors that stalled oil price rise

These are the factors that stalled the recovery of crude oil market, when the analysts and investors thought effect of Covid 19 was behind them. The situation is evolving; if the impact of the second wave of Covid-19 is not as bad as that of the first, things will improve, but that rate will be painf…

Friday, 11 September 2020

Oil Price Stagnation: rise in US crude oil stocks partially explains it...

Oil price has been seesawing worryingly in the last

few days, reflecting the volatile nature both in the political and economic

realms, partly being shored up by the pandemic and the possibility of its ‘second coming’. The demand has been very low and it’s understandable

in the current circumstances.…

Wednesday, 9 September 2020

Stalled Oil Price Recovery: a factor often overlooked

Oil price

has stalled and the stagnation, coupled with gloomy outlook on many other

fronts, have left economists and analysts in limbo, as the combination of

existing knowledge and experience does not give an impetus to come up with a

solution. Whatever the

in-depth analyses that surface in heighten…

Tuesday, 8 September 2020

Oil Price: no sign of strong recovery in Asia

As Saudi

Arabia cut oil price for Asian region on the grounds of faltering demand,

Reuters reports more bad news for the market. According to

the report, Oil importers in Vietnam have been compelled to offer bonus to

retailers to buy oil in order to clear their mounting oil stocks at ports. The lack …

Monday, 7 September 2020

Saudi Arabia to Cut Crude Oil Price: OPEC cuts did not do the trick intended

The investor

lethargy continues in the oil markets in proportion to the degree of negative sentiment

that looms over it. The early drop

in price in Brent crude and WTI crude, 1.35% and 1.6% respectively on Monday,

just reflects the current pessimistic mood in the markets. With the

production cuts ini…

Sunday, 6 September 2020

Weekly Oil Price: IEA and Russia predict a big drop in demand

The uncertainty that hangs over the oil markets shows no

sign of abating. The Chinese crude oil stocks do not diverge from storage facilities

as fast as analysts thought they would, leaving many tankers waiting at the

ports. To make matters worse, Russia’s oil minister said that he

would expect the g…

Saturday, 5 September 2020

Drop in Oil Price: factors at play

Even before the forecast by the EIA of impending drop in price at the pumps

during the US Labour weekend, the price of the commodity had been in

decline, not plummeting. The trend appeared, even when there was no significant increase in US crude

oil inventories. On Thursday, the main crude oil benchm…

Friday, 4 September 2020

Oil price at the pump in the US plunges: crude follows

It

doesn't come as a surprise owing to the lower demand and economic uncertainties

across the globe, involving all major economies. The

EIA, the US Energy Information Administration, says the price of gasoline stands

at just $2.20, before the Labour Day weekend – the lowest since 2004. Reflecting…

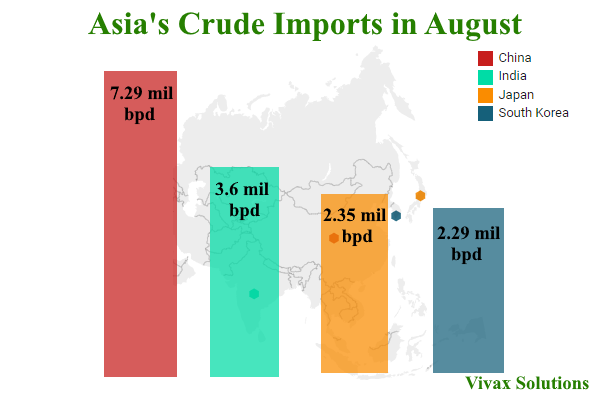

Asian Crude Oil Imports in August

The data clearly shows that the imports were far below the estimated values for August - for obvious reasons. The analysts, however, are particularly concerned about China's

muted interest in sticking to its buying spree that it used to pursue at the

height of the pandemic, while cashing in on r…

Thursday, 3 September 2020

US Crude Oil Inventories Drop - Hurricane Laura to blame

Usually, the drop in US crude oil inventories ia a health sign of demand going up, if other main factors support the trend. The sharp drop in crude oil stocks last week, however, is attributed to the hurricane forced to reduce the production in offshore oil facillities, according to EIA, Energy Inf…

Wednesday, 2 September 2020

Recovery of Crude Oil Prices: the appearance of green shoots

The EIA, citing the commercial flight data from Cirium, says that the demand for jet fuel has recovered faster than we all feared during the pandemic. Since the above data source accounts for more than 73% of US commercial flights, according to the EIA, it is a pretty reliable indicator about the fa…

Tuesday, 1 September 2020

Brent Crude go above $50, only in 2021 - Reuters Survey

According to a survey carried out by Reuters, listening to some analysts and economists, most of the people in the field think it's highly unlikely that the price of Brent crude will go past $50. The people in the survey cite the following factors for the gloomy outlook: Contracting global deman…

Oil Price - the US inventory count is a major factor

In the absence of a major international event, especially related to terrorism or stemming from a simmering political issue in the Middle East, the oil price is affected by US crude stocks. In short, the oil price is inversely proportional to this crucial factor, as the US crude stocks clearly refl…

Saudi and Chinese firms register record losses

Despite the relatively steady oil price in the global market, the large oil firms in China and Saudi Arabia have recorded massive losses. During the pandemic, China saw an opportunity when the oil prices fell to record low levels; once it even turned negative, leaving economists in an enviable acade…

Subscribe to:

Comments (Atom)

Search for Articles

Popular Posts

-

The bearish sentiment in the crude oil markets continues unabated, despite the substantial drawdowns in US crude oil inventories. According ...

-

The U.S. Energy Information Administration (EIA) projects that crude oil prices will remain stable for the third quarter of 2025, primarily ...

-

Oil prices appear to be trending toward the mid-fifty dollar mark, a trajectory many analysts predicted months ago. As of 11:37 GMT on Wedne...

-

The price stagnation of crude oil continues amid evolving tariff issues between the United States, the world's largest economy, and th...

TOP CATEGORIES

Featured Post

Labels

Crude Oil Prices

(508)

Global Politics & Energy

(508)

Crude Oil Prices

(52)

featured

(8)

Gas Prices

(519)

Global Politics & Energy

(79)

Oil & Gas Market Analysis

(575)

Blog Archive

-

▼

2020

(69)

-

▼

September

(28)

- Oil Price: Light at the End of the Tunnel, at last...

- Oil price gains stability: this is a key factor!

- Will the oil price come out of the bearish territo...

- Inventory draws and supply constrains will stabili...

- US Oil Exports are on decline since the Covid-19 C...

- Making hay while the sun shines: India saves milli...

- Oil Price: upward momentum noticed at the weekend

- Hurricane Teddy: new threat to oil supply and dist...

- Ripples caused by BP Oil Outlook 2020

- Oil Price Slightly Goes Up: Hurricane Sally causes...

- Oil Price: the long road to recovery and green shoots

- Clear Evidence that Fossil Fuels are Here to Stay...

- Recovery of Oil Price and Keeping Covid-19 at Bay ...

- US oil rig counts fell this week

- Factors that stalled oil price rise

- Oil Price Stagnation: rise in US crude oil stocks ...

- Stalled Oil Price Recovery: a factor often overlooked

- Oil Price: no sign of strong recovery in Asia

- Saudi Arabia to Cut Crude Oil Price: OPEC cuts did...

- Weekly Oil Price: IEA and Russia predict a big dro...

- Drop in Oil Price: factors at play

- Oil price at the pump in the US plunges: crude fol...

- Asian Crude Oil Imports in August

- US Crude Oil Inventories Drop - Hurricane Laura to...

- Recovery of Crude Oil Prices: the appearance of gr...

- Brent Crude go above $50, only in 2021 - Reuters S...

- Oil Price - the US inventory count is a major factor

- Saudi and Chinese firms register record losses

-

▼

September

(28)